CKYC Software Solution

Effortlessly integrate with CKYC for seamless compliance and easy customer KYC fetch.

Introduction

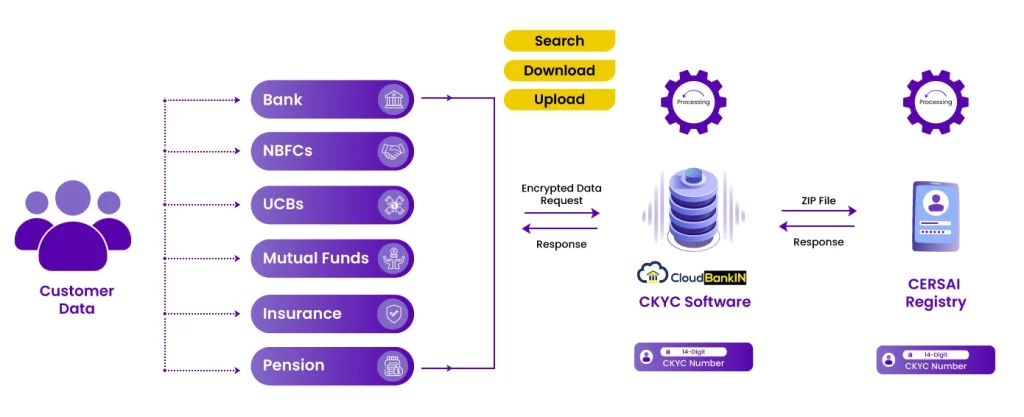

CloudBankin’s platform serves as a comprehensive solution provider for the Central Know Your Customer (CKYC) initiative, initiated by the Indian Government. CKYC is a scheme designed to digitize and centralize KYC records in the financial industry. The objective is to minimize the need for repetitive KYC verifications. The responsibility of managing this CKYC database lies with the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI).

With CloudBankin’s CKYC API integrated into your system, the platform ensures strict adherence to the guidelines set by CERSAI and the RBI. Through our meticulously developed CKYC Solution Provider, we facilitate a streamlined process, making it a one-stop point for all your KYC requirements!

Functionality of our CKYC Software

- Offers a comprehensive approach to effectively managing the entire CKYC flow.

- By uploading customers' KYC data and images through financial institutions (FIs), the software interacts seamlessly with the government portal.

- This automated solution simplifies compliance rules, assisting financial institutions in fulfilling their regulatory obligations.

- Optimization in the overhead cost of KYC.

- One-stop and one-time verification point for all FIs.

- Easy accessibility of KYC records.

CloudBankin CKYC Data Flow

Key Features

Upload of KYC Records

Enable automated and seamless upload of KYC records through our APIs, significantly reducing manual effort while ensuring accuracy.

Search & Download

Effortlessly search and download customer KYC information directly from the CKYC database.

CKYC API Integration

Effortless API integration of the core data system of FIs with CKYCR, enabling intelligent search, download & upload of customer information.

Regular Update of KYC

Ensures efficient updating of customer KYC data.

File Generation

Ability to create CKYC File Formats and offers the option to export a customer’s file in bulk.

Why Choose Us?

- Enhanced Compliance: Ensure complete compliance of customer accounts with regulatory requirements.

- Seamless Integration: Seamlessly integrates with existing legacy systems and back-office solutions, guaranteeing a hassle-free implementation process.

- Increased Efficiency: Automated processes, such as bulk upload/download and search, and data extraction, minimize manual intervention, thereby improving overall operational efficiency.

- Customizable Solution: We understand that each institution has unique requirements. Therefore, our software can be tailored to meet your specific needs, providing a fully customized CKYC software solution.

- Full Automation: Achieve a high level of automation, reducing manpower requirements and minimizing errors.

- Robust Security: We prioritize data security, ensuring that all customer information is stored in an encrypted format for data transfer.

- Expert Support: Our dedicated team of experts provides end-to-end support, assisting you from CKYC registration to offering subject matter expertise.

How Can CloudBankin CKYC Help You?

Ensure complete compliance of your customer accounts. Seamlessly integrate with the CKYCR. Experience the benefits of automation and customization with CloudBankin CKYC API solution. Speed up your customer onboarding time by a whopping 90% while providing your customers with a seamless and hassle-free experience. Say goodbye to the tedious manual onboarding process and say hello to a world of streamlined efficiency and customer satisfaction!

Frequently Asked Questions

Define CKYC.

CKYC, also known as Central Know Your Customer, serves as a centralized repository for KYC data utilized by clients within the financial services sector. Its primary objective is to streamline verification processes, bolster security measures, minimize documentation, and elevate the overall customer journey.

How does a CKYC Software solution work?

A CKYC software solution is a digital tool that assists financial institutions (FIs) in efficiently retrieving their customers' KYC information through API integration. This CKYC API solution enables seamless integration with CERSAI, enabling FIs to perform tasks such as uploading, searching, downloading, and updating CKYC records. By streamlining the KYC process, it enhances the speed and efficiency of customer onboarding.

Which entities are eligible to register their customers with CKYC?

Entities operating in the financial sector and holding registrations with regulatory authorities such as the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), and Pension Fund Regulatory and Development Authority (PFRDA) are allowed to register their customers in the CKYC platform.

How many CKYC records does the CKYC Record Registry contain?

As of March 2023, the CKYC Record Registry holds over 70 Crore CKYC records.

How much time does it take to generate 1000 records for CKYC Upload?

50 minutes

What's the maximum limit of customer records CKYC server can handle?

a) Bulk upload using portal accepts max 25 MB (maximum size of single individual record should be 350 kb, maximum size of single entity record should be 5 MB) b) Bulk SFTP over Internet - No Limit c) Bulk SFTP over leased lines - No Limit

If a financial institution has more customer records, say 1 Lakh, how will they upload data in the CKYC portal?

a) Through bulk upload - Manually b) Through bulk upload - SFTP

As soon as we upload customer records to CKYC, when will we get the response from CKYC? Is it real time?

The response will occur in three phases: a) After performing the SFTP upload, you will receive the initial response, 'response_0', in the 'SFTP response' folder. This response will be generated immediately and will solely verify the validity of the data format. b) At the Checker level, the same response will be received for authorization purposes. Once it is approved, a subsequent response called 'response_1' will be generated. c) In 'response_1', you will receive an 11-digit reference number that can be used to track the status of the upload. The final response, indicating either rejection or approval, will be generated within 24 hours.

If any customer's data gets rejected by CKYC after the upload, what steps can be taken to rectify the issue?

A response will be generated. The response will contain the reference number of the failed (rejected) records along with the reasons for the rejection.

Why might a customer record be rejected by CKYC?

Potential reasons for rejection include: a) incorrect or invalid identification information, b) missing required information, c) absence of an image file, d) document mapping inconsistencies, and e) invalid data formatting.

As a financial institution with 20,000 records (for instance), if you utilize CloudBankin's CKYC software, will your customer data be stored in CloudBankin's system?

No, according to the rules, without the permission of the financial institution (FI), the data cannot be stored. Only if the FI grants permission, requests it, or allows it, the data can be stored in an encrypted format.

Which algorithm will you use to compress the image?

java.awt.image package

For 100 records, what will be the approximate file size that is generated?

1. For 100 records of individual type, maximum size of ZIP file must be 35 MB. 2. For 100 records of entity type, maximum size of ZIP file must be 500 MB

How can you determine the number of customers for whom a financial institution has utilized the Search and Download functionalities?

To track the usage of the Search & Download functionalities, the financial institution assigns a unique reference ID to each request. By analyzing these reference IDs, along with the type of request and its status, we can accurately determine the number of hits. The system maintains a unique identifier for each hit, ensuring accurate tracking of usage.

After smartphone penetration, people are not watching their SMS at all. They use SMS only for OTP related transactions. That’s it.

But What can a Lender see in your SMS after you consent to them?

Lender can see income, expenses, and any other Fixed Obligation like (EMIs/Credit Card).

1) Income – Parameters like Average Salary Credited, Stable Monthly inflows like Rent

2) Expenses – Average monthly debit card transactions, UPI Transactions, Monthly ATM Withdrawal Amount etc

3) Fixed Obligations – Loan payments have been made for the past few months, Credit card transactions.

It also tells the Lender the adverse incidents like

1) Missed Loan payments

2) Cheque bounces

3) Missed Bill Payments like EB, LPG gas bills.

4) POS transaction declines due to insufficient funds.

A massive chunk of data is available in our SMS (more than 700 data points), which helps Lender to make a credit decision.

#lendtech #fintech #manispeaksmoney