Credit Reporting Format For Financial Institutions By The RBI

Reading Time : 15 Mins

Credit Reporting Format For Financial Institutions By The RBI

Let’s decode the RBI’s credit reporting format for financial institutions. It acts as a beacon for financial entities, ensuring data integrity and streamlined operations.

Access the complete documentation from here.

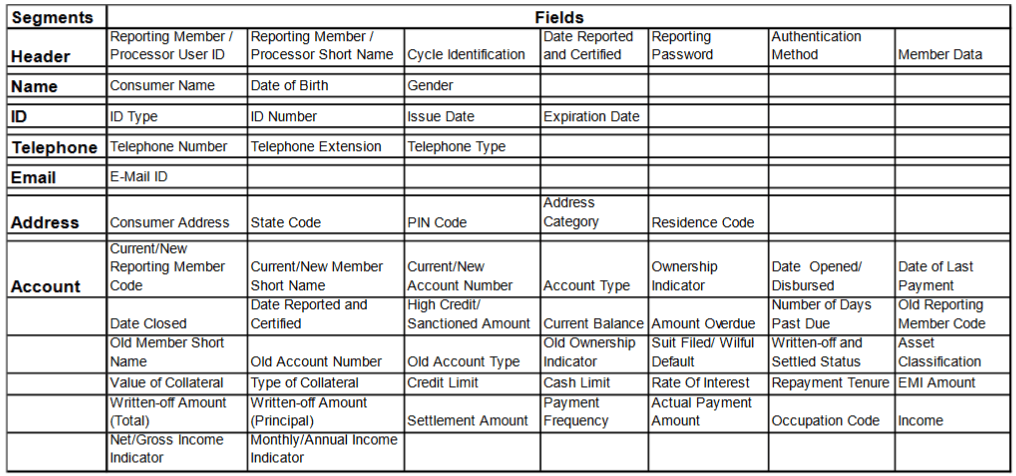

Credit Reporting Format For Consumer Borrowers

(Image Credit: Equifax)

What’s Segments Are Included?

1. Header

- Reporting Member / Processor User ID: This field likely identifies the unique ID of the reporting member or the processor user. It ensures that the data is traceable back to the source.

- Reporting Member / Processor Short Name: A concise name or abbreviation for the reporting member or processor. This provides a quick reference to the entity submitting the data.

- Cycle Identification: This might refer to the specific reporting cycle or period, helping in organizing and categorizing the data.

- Date Reported and Certified: The date when the data was reported and verified. This ensures the timeliness and authenticity of the information.

- Reporting Password: A security measure to ensure that only authorized entities can submit data.

- Authentication Method: The method used to verify the identity of the reporting entity, ensuring data integrity and security.

- Member Data: General data or metadata about the reporting member.

2. Name

- Consumer Name: The full name of the consumer whose credit information is being reported.

- Date of Birth: The birthdate of the consumer, which can be crucial for identity verification.

- Gender: The gender of the consumer.

3. ID

- ID Type: The type of identification document (e.g., PAN, Aadhar, Passport, Driver’s License).

- ID Number: The unique number associated with the identification document.

- Issue Date: The date when the ID was issued.

- Expiration Date: The date when the ID will expire.

4. Telephone

- Telephone Number: The primary contact number of the consumer.

- Telephone Extension: Any extension number associated, typically used for landlines within large organizations.

- Telephone Type: The kind of telephone (e.g., Mobile, Landline).

5. Email

- E-Mail ID: The email address of the consumer.

6. Address

- Consumer Address: The full residential address of the consumer.

- State Code: The code representing the state of residence.

- PIN Code: The postal code of the consumer’s address.

- Address Category: The type or category of the address (e.g., Permanent, Temporary).

- Residence Code: A code indicating the type of residence (e.g., Owned, Rented).

7. Account

- Current/New: Indicates if the account is a newly opened one or an existing one.

- Reporting Member Code: Unique code identifying the financial institution reporting the account details.

- Current/New Member Short Name: Abbreviated name of the current or new reporting member.

- Current/New Account Number: Unique number identifying the current or new account.

- Account Type: Specifies the kind of account (e.g., Savings, Loan).

- Ownership Indicator: Shows the ownership type of the account (e.g., Individual, Joint).

- Date Opened/Disbursed: The date when the account was opened or loan was disbursed.

- Date of Last Payment: The date of the most recent payment made on the account.

- Date Closed: The date when the account was closed or settled.

- Date Reported and Certified: The date the account details were reported and verified.

- High Credit/Sanctioned Amount: The maximum credit limit or loan amount sanctioned.

- Current Balance Amount: The outstanding balance in the account as of the report date.

- Overdue Number of Days Past Due: Number of days the payment is overdue.

- Old Reporting Member Code: Code of the previous financial institution that reported the account.

- Old Member Short Name: Abbreviated name of the previous reporting member.

- Old Account Number: Unique number identifying the old account.

- Old Account Type: Specifies the kind of the old account.

- Old Ownership Indicator: Shows the ownership type of the old account.

- Suit Filed/Wilful Default: Indicates if any legal action has been taken or if there’s a deliberate default.

- Written-off and Settled Status: Status indicating if the account has been written off or settled.

- Asset Classification: Categorization of the account based on its risk (e.g., Standard, Substandard).

- Value of Collateral: The monetary value of any collateral held against the account.

- Type of Collateral: The kind of collateral (e.g., Property, Gold).

- Credit Limit: The maximum amount that can be borrowed or spent on the account.

- Cash Limit: The maximum cash amount that can be withdrawn or borrowed.

- Rate Of Interest: The interest rate applicable to the account.

- Repayment Tenure: The duration over which the borrowed amount is to be repaid.

- EMI Amount: The monthly instalment amount to be paid.

- Written-off Amount (Total): Total amount that has been written off as uncollectible.

- Written-off Amount (Principal): Principal amount that has been written off.

- Settlement Amount: Amount agreed upon for settlement of the account.

- Payment Frequency: How often payments are made (e.g., Monthly, Quarterly).

- Actual Payment Amount: The actual amount paid in the most recent transaction.

- Occupation Code: Code indicating the consumer’s occupation type.

- Income Net/Gross Income Indicator: Specifies if the reported income is net or gross.

- Monthly/Annual Income Indicator: Indicates the frequency of the reported income.

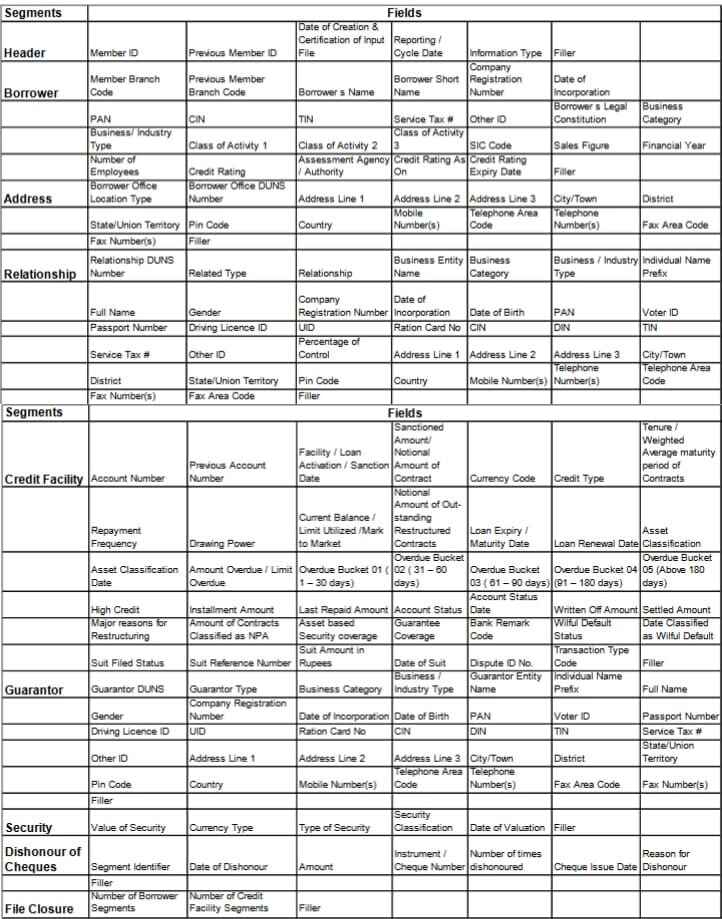

Credit Reporting Format For Commercial Borrowers

(Image Credit: Equifax)

What’s Segments Are Included?

1. Header

- Member ID: A unique identifier for the financial institution reporting the data.

- Previous Member ID: The identifier for the institution that previously reported the data, if applicable.

- Date of Creation & Certification of Input File: The date when the report was created and subsequently certified for accuracy.

- Reporting / Cycle Date: The specific date or period the report pertains to.

- Information Type: Specifies the nature of the information being reported (e.g., new account, overdue payment).

2. Borrower

- Member Branch Code: A unique code identifying the specific branch of the reporting financial institution.

- Previous Member Branch Code: The code for the branch that previously reported the data, if any.

- Borrower’s Name: The full legal name of the commercial borrower.

- Borrower Short Name: A concise or abbreviated name for the borrower, often used for quick reference.

- Company Registration Number: The official registration number of the borrower if it’s a company, indicating its legal recognition.

- Date of Incorporation: The date when the company (borrower) was officially incorporated or established.

- PAN: Permanent Account Number, a unique tax code for entities in India.

- CIN: Corporate Identification Number, specific identifier for companies.

- TIN: Taxpayer Identification Number, specific identifier for taxpayers.

- Service Tax #: The unique number associated with the borrower’s service tax registration.

- Other ID: Any other identification number or code associated with the borrower.

- Borrower’s Legal Constitution: The legal structure of the borrower (e.g., Private Limited, Partnership).

- Business Category: The broad category of the borrower’s business (e.g., Manufacturing, Services).

- Business / Industry Type: A more specific classification of the borrower’s industry or sector.

- Class of Activity 1, 2, 3: Specific activities or operations the borrower is involved in.

- SIC Code: Standard Industrial Classification code, used for categorizing industries.

- Sales Figure: The reported sales or revenue figure for the borrower.

- Financial Year: The fiscal year associated with the reported sales figure.

- Number of Employees: The total workforce count of the borrower.

- Credit Rating: The creditworthiness rating assigned to the borrower.

- Assessment Agency / Authority: The agency or body that provided the credit rating.

- Credit Rating As On: The date when the credit rating was assigned.

- Credit Rating Expiry Date: The date when the credit rating will be up for review or renewal.

3. Address

- Borrower Office Location Type: Specifies the nature of the office location (e.g., Headquarters, Branch Office).

- Borrower Office DUNS Number: A unique identifier, typically used for businesses, provided by Dun & Bradstreet.

- Address Lines 1, 2, 3: Detailed address lines capturing the exact location of the borrower’s office.

- City/Town: The city or town where the borrower’s office is located.

- District: The specific district of the office location.

- State/Union Territory: The state or union territory in which the office is situated.

- Pin Code: The postal code associated with the office address.

- Country: The country where the borrower’s office is located.

- Mobile Number(s): Contact mobile number(s) associated with the borrower or the office.

- Telephone Area Code: The area code for landline numbers.

- Telephone Number(s): Landline contact number(s) for the borrower’s office.

- Fax Area Code: The area code for fax communications.

- Fax Number(s): Fax number(s) associated with the borrower’s office.

4. Relationship

- Relationship DUNS Number: A unique identifier, typically for businesses, indicating a relationship with another entity, provided by Dun & Bradstreet.

- Related Type: Specifies the nature of the relationship (e.g., Parent Company, Subsidiary).

- Relationship: Describes the specific relationship between the borrower and the related entity (e.g., Owner, Partner).

- Business Entity Name: The name of the related business entity.

- Business Category: The broad category of the related business (e.g., Manufacturing, Services).

- Business / Industry Type: A more specific classification of the related business’s industry or sector.

- Individual Name Prefix: Prefix for the individual’s name (e.g., Mr., Mrs.).

- Full Name: The complete name of the related individual.

- Gender: Gender of the related individual.

- Company Registration Number: The official registration number if the related entity is a company.

- Date of Incorporation: The date when the related company or business entity was legally established.

- Date of Birth: Birthdate of the related individual.

- PAN: Permanent Account Number, a unique tax code for entities in India.

- Voter ID: Identification number from the voter registration of the related individual.

- Passport Number: Passport number of the related individual.

- Driving Licence ID: Driving license number of the related individual.

- UID: Unique Identification number, often referring to the Aadhaar number in India.

- Ration Card No: Ration card number, a form of identification in India.

- CIN: Corporate Identification Number for companies.

- DIN: Director Identification Number, specific to individuals who are directors of companies.

- TIN: Taxpayer Identification Number.

- Service Tax #: The unique number associated with the related entity’s service tax registration.

- Other ID: Any other identification number or code associated with the related entity.

- Percentage of Control: Indicates the extent of control or stake the borrower has in the related entity.

- Address Lines 1, 2, 3: Detailed address lines capturing the exact location of the related entity.

- City/Town: The city or town where the related entity is located.

- District: The specific district of the related entity’s location.

- State/Union Territory: The state or union territory in which the related entity is situated.

- Pin Code: The postal code associated with the related entity’s address.

- Country: The country where the related entity is located.

- Mobile Number(s): Contact mobile number(s) associated with the related entity.

- Telephone Number(s): Landline contact number(s) for the related entity.

- Telephone Area Code: The area code for landline numbers of the related entity.

- Fax Number(s): Fax number(s) associated with the related entity.

- Fax Area Code: The area code for fax communications of the related entity.

5. Credit Facility

- Account Number: Unique identifier for the borrower’s credit account.

- Previous Account Number: Identifier for the borrower’s prior credit account, if applicable.

- Facility/Loan Activation/Sanction Date: The date when the credit facility or loan was officially approved and activated.

- Sanctioned Amount/Notional Amount of Contract: The total amount approved for the credit facility or the notional value of a financial contract.

- Currency Code: The currency in which the credit facility is denominated.

- Credit Type: Specifies the kind of credit (e.g., Term Loan, Overdraft).

- Tenure/Weighted Average maturity period of Contracts: Duration of the loan or the average maturity period of financial contracts.

- Repayment Frequency: How often the borrower is expected to make repayments.

- Drawing Power: The maximum amount the borrower can draw from the credit facility.

- Current Balance/Limit Utilized/Mark to Market: The outstanding balance or the amount utilized from the credit limit, or the current market valuation.

- Notional Amount of Outstanding Restructured Contracts: The hypothetical or notional value of contracts that have been restructured.

- Loan Expiry/Maturity Date: The date when the loan will come to its end or mature.

- Loan Renewal Date: The date when the loan can be renewed or rolled over.

- Asset Classification: Categorization based on risk (e.g., Standard, Substandard).

- Asset Classification Date: The date when the asset was categorized based on its risk.

- Amount Overdue/Limit Overdue: The total amount or limit that hasn’t been paid or settled by the due date.

- Overdue Buckets 01 to 05: Specific categorizations based on the number of days the payment is overdue, starting from day 1 to above 180 days.

- High Credit: The highest amount ever owed on the account.

- Installment Amount: The amount to be paid in each instalment.

- Last Repaid Amount: The amount paid in the most recent transaction.

- Account Status: Current status of the account (e.g., Active, Closed).

- Account Status Date: The date when the account status was last updated.

- Written Off Amount: Amount that has been deemed uncollectible and written off.

- Settled Amount: Amount agreed upon for settlement of the account.

- Major reasons for Restructuring: Primary reasons why the credit facility or contract was restructured.

- Amount of Contracts Classified as NPA: Value of contracts that have been classified as Non-Performing Assets.

- Asset-based Security coverage: The coverage or value of assets held as security against the loan.

- Guarantee Coverage: The extent to which the loan is covered by guarantees.

- Bank Remark Code: A code indicating specific remarks or notes from the bank regarding the account.

- Wilful Default Status: Indicates if the borrower has been classified as a wilful defaulter.

- Date Classified as Wilful Default: The date when the borrower was labelled as a wilful defaulter.

- Suit Filed Status: Indicates if any legal action has been initiated against the borrower.

- Suit Reference Number: A unique number associated with the legal action.

- Suit Amount in Rupees: The amount involved in the legal action.

- Date of Suit: The date when the legal action was initiated.

- Dispute ID No.: If there’s any dispute related to the account, this number identifies it.

- Transaction Type Code: The code indicating the nature of the recent transaction on the account.

6. Guarantor

- Guarantor DUNS: A unique identifier for the guarantor, typically used for businesses, provided by Dun & Bradstreet.

- Guarantor Type: Specifies the type of guarantor (e.g., Individual, Corporate).

- Business Category: The broad category of the guarantor’s business (e.g., Manufacturing, Services).

- Business / Industry Type: A more specific classification of the guarantor’s industry or sector.

- Guarantor Entity Name: The name of the business entity acting as a guarantor.

- Individual Name Prefix: Prefix for the individual’s name (e.g., Mr., Mrs.).

- Full Name: The complete name of the guarantor if it’s an individual.

- Gender: Gender of the guarantor if it’s an individual.

- Company Registration Number: The official registration number if the guarantor is a company.

- Date of Incorporation: The date when the guarantor company or business entity was legally established.

- Date of Birth: Birthdate of the guarantor if it’s an individual.

- PAN: Permanent Account Number, a unique tax code for entities in India.

- Voter ID: Identification number from the voter registration of the guarantor.

- Passport Number: Passport number of the guarantor.

- Driving Licence ID: Driving license number of the guarantor.

- UID: Unique Identification number, often referring to the Aadhaar number in India.

- Ration Card No: Ration card number, a form of identification in India.

- CIN: Corporate Identification Number for companies.

- DIN: Director Identification Number, specific to individuals who are directors of companies.

- TIN: Taxpayer Identification Number.

- Service Tax #: The unique number associated with the guarantor’s service tax registration.

- Other ID: Any other identification number or code associated with the guarantor.

- Address Lines 1, 2, 3: Detailed address lines capturing the exact location of the guarantor.

- City/Town: The city or town where the guarantor is located.

- District: The specific district of the guarantor’s location.

- State/Union Territory: The state or union territory in which the guarantor is situated.

- Pin Code: The postal code associated with the guarantor’s address.

- Country: The country where the guarantor is located.

- Mobile Number(s): Contact mobile number(s) associated with the guarantor.

- Telephone Area Code: The area code for landline numbers of the guarantor.

- Telephone Number(s): Landline contact number(s) for the guarantor.

- Fax Area Code: The area code for fax communications of the guarantor.

- Fax Number(s): Fax number(s) associated with the guarantor.

7. Security

- Value of Security: The monetary value of the collateral or asset held as security against the loan.

- Currency Type: The currency in which the valuation of the security is done.

- Type of Security: Specifies the kind of collateral provided against the loan (e.g., Property, Gold, Shares).

- Security Classification: Categorization of the security based on its nature or quality (e.g., Prime, Subprime).

- Date of Valuation: The date when the collateral or security was last assessed or valued.

8. Dishonour of Cheques

- Segment Identifier: A unique code or identifier for this specific segment within the report.

- Date of Dishonour: The date when the cheque was not honoured by the bank.

- Amount: The monetary value of the dishonoured cheque.

- Instrument/Cheque Number: The unique number associated with the dishonoured cheque.

- Number of times dishonoured: Indicates how many times this particular cheque has been dishonoured.

- Cheque Issue Date: The date when the cheque was originally issued by the borrower.

- Reason for Dishonour: The specific reason provided by the bank for not honouring the cheque (e.g., Insufficient Funds, Account Closed).

9. File Closure

- Number of Borrower Segments: Indicates the total count of borrower segments associated with the report or file.

- Number of Credit Facility Segments: Specifies the total count of credit facility segments related to the report or file.

Credit Reporting Format For Micro-Finance Institutions

You can find the credit reporting format for the MFIN Segment here.

Take a look at why uniform credit reporting is significant and how it benefits financial institutions in the next chapter.

Related Post

20

Sep

Introduction: Credit Reporting to Credit Bureau by Financial Institutions

Key Players: Financial Institutions in Credit Reporting Banking Companies: These

23

Feb

5 Use Cases to drive ROI through BNPL as a Lender

The pandemic-induced economy has expanded the credit market in India

29

Jul

The Indian Loan Management System – During and After the Pandemic

The pandemic has affected individuals, businesses, communities and economies globally.

- Email: salesteam@cloudbankin.com

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576