What is Co-Lending and

How will NBFCs Benefit From It?

With more than 1.4 billion in India, nearly 63% of the population still live in rural areas, with a significant part remaining unaware of formal financial services. Even today the LIG (Low-Income Group), the EWS (Economically Weaker Sections) categories, the priority sector (including agriculture, the micro, small, and medium enterprise (MSME) segment), and other critical sectors are finding it difficult to access the liquidity required for their daily working capital needs.

The people in these segments contribute majorly to India’s economic growth so making financial services available to these categories is crucial. For instance, the MSME sector alone contributes about one-third of the economic growth of India, which is also expected to contribute $1 trillion to India’s exports by 2028.

The Reserve Bank of India identified this gap faced by the MSMEs and other priority sectors and introduced a policy change of which Co-Lending is a major component. While the adoption of formal financial services has been slow in these segments, the co-lending model is preferred by these people for the ease of cash transactions.

Co-Lending: What is it?

Co-lending is a lending arrangement where a traditional lender such as a bank, partners with a non-banking financial company (NBFC) to provide loans so that both lenders in conjunction can improve the credit flow to the underserved sectors at affordable rates. While the NBFCs (Non-Banking Financial Companies) would do the grunt work of loan origination and paperwork, banks would offer their liquidity strength to finance a majority of the loan. This partnership creates a symbiotic relationship where both parties benefit and share the risks and rewards throughout the loan lifecycle.

NBFCs have always benefited from their ability to pierce smaller, harder-to-reach geographical areas through the use of modern loan origination software and banking practices. Banks, on the other hand, have bigger wads of cash, and bigger fee structures. But the problem is banks were not able to reach the underserved population and the NBFCs don’t have enough cash to serve these segments. Co-lending is a give-and-take model by which NBFCs can improve their liquidity, profitability, and client base. At the same time, banks can take advantage of the market outreach, loan origination, and servicing acumen of NBFCs.

The co-lending book of NBFCs is expected to reach Rs 1 trillion by June 2024, after more than 5 years since the model came into being. This indicates significant growth in the adoption of co-lending arrangements.

How can a Co-lending Model drive financial inclusion and economic growth?

The priority sector has ever since played a crucial role in advancing financial inclusion and the overall growth of the economy. However, the traditional lending approach followed by the banks makes it a challenge for the priority sectors to access liquidity. While NBFCs that are in close connection with this segment lack the liquidity to bridge this gap. As per statistics, bank credit growth in India will be in the range of 14-14.5% for the financial year 2024-25. These numbers highlight the potential for growth in India’s banking sector, underscoring the importance of including banks in the meaningful expansion of credit. The co-lending model acknowledges that banks dominate vast liquidity reserves and presents an opportunity to leverage this untapped potential.

On one hand, co-lending gives credit access to a higher number of individuals and business entities served by NBFCs. On the other hand, banks can utilize technology in back-end operations, KYC processes, and documentation. This enables seamless credit flow to the underserved. This means banks can extend credit to borrowers, whose loan applications would otherwise be rejected. This leads to greater financial inclusion.

Terms of a Co-Lending Arrangement

On 5th Nov 2020, RBI released a notification titled ‘Co-Lending by Banks and NBFCs to Priority Sector‘ that served as a revision to the 2018 loan co-origination scheme, amended to include Housing Finance Companies (HFCs) under the umbrella term of Non-Banking Financial Companies (NBFCs). The following are some of the typical terms of the agreement between the parties,

- 80-20 split: Banks and NBFCs will usually take on an 80:20 capital deployment ratio, with NBFCs mandated to maintain at least 20% of the funding throughout the loan term. Both parties’ funds must be collected and allocated in their agreed ratio at the time of funding and at the time of repayment collections, in such a way that neither party uses the funds that belong to the other.

- Joint underwriting: As both entities are equally involved in the lending arrangement, the underwriting is also done jointly, allowing for double checks.

- Risk-return split: The 80:20 split for capital deployment also trickles down to the amount of risk and return that is split between the two entities.

- Final interest rate: Both parties can charge their own interest rates and the final interest rate charged to the customers is generally a blended interest rate, which lies between the interest rate charged individually by the bank and NBFC.

- Defined roles: Generally, the NBFC is responsible for sourcing, customer experience and management, product innovations, quick documentation, and fast turnaround time, whereas the banks are responsible for bringing in funds and establishing credibility. Risk assessment is done by both NBFC and the partner bank and the loan origination will be done by the NBFC to the customers.

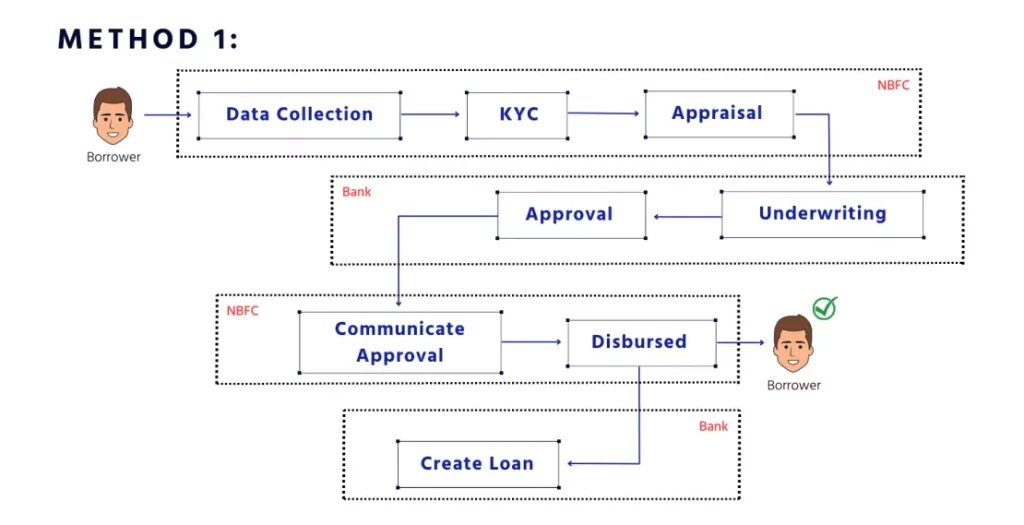

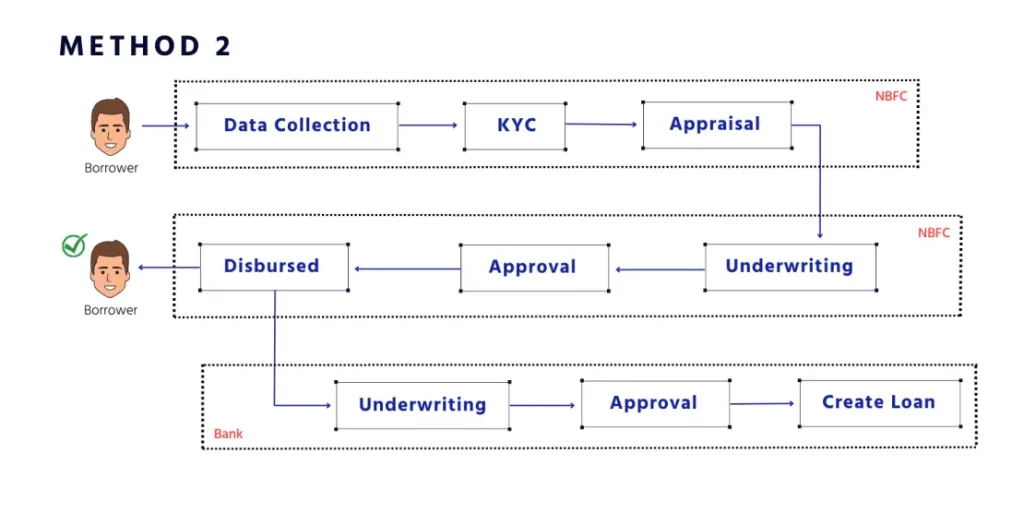

How does a Co-Lending Agreement Work?

Here are the 4 steps on how Co-Lending works,

- First, the NBFC performs loan origination activities through co-lending software and checks on the prospective client, after which it recommends him/her to the partner bank with the relevant documentation.

- The bank independently does requirement analysis and risk assessment of the client and vets him/her if found creditworthy.

- NBFCs and banks enter a tripartite agreement with customers if they meet all requirements, between lenders and borrowers.

- The bank and NBFC pool their funds into a common escrow account from which the loan shall be disbursed. Each lender allocates funds as per the pre-decided ratio in the agreement. Although both lenders will maintain the client’s accounts, they must share information and collaborate to generate a unified statement of accounts for the borrower for easier repayments.

Features of the Current Co-Lending Model

Co-lending has been adopted by various financial institutions including banks, credit unions and online lenders across the world. Sometimes, NBFCs can also tie up with multiple banks for a distributed capital deployment; for example, the NBFC puts a 25% stake, Bank A lends 40% and Bank B gives 35% of the loan amount.

Also when multiple lenders are involved in the lending process, the borrower’s credit will be evaluated by more than one lender. This increases the chances of approval for a loan. Also, co-lending results in a lower interest rate for the borrower as the lenders offer more competitive rates due to shared risk.

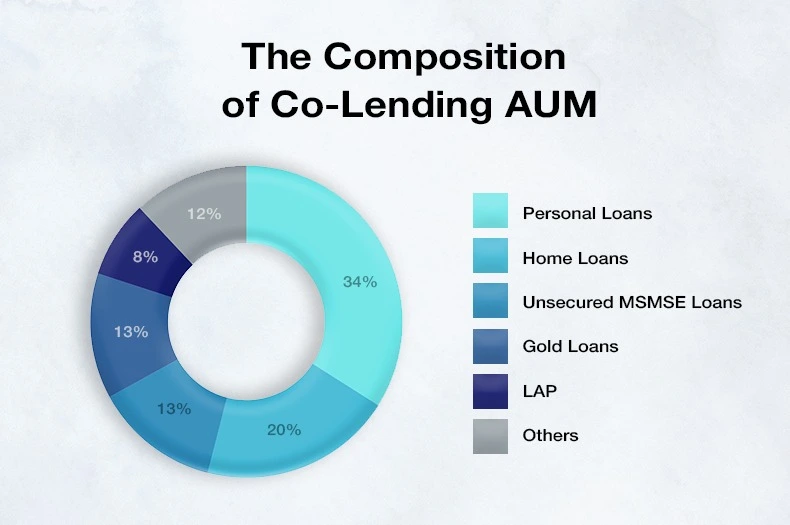

Given the higher risk weights imposed on personal loans by the Reserve Bank of India (RBI) in November 2023, there is a potential shift in focus towards other asset classes like loans to micro, small, and medium enterprises (MSME) and home loans.

Presently, personal loans are one-third of the overall co-lending book. Housing loans (20%), unsecured MSME loans (13%), gold loans (13%), and secured MSME loans including loans against property and vehicle loans comprise the rest 20%.

A pie chart representation of the Composition of

Co-Lending AUM

While co-lending books for all asset classes will grow, the pace of growth for personal loans is expected to be slower (25-35% in fiscal 2025) than in the recent past (~35% in fiscal 2024) due to the revision in risk weight of unsecured consumer credit to 125% from 100%. Banks are likely to be more inclined to partner with NBFCs for business loans and secured loans instead of personal loans, given the higher risk associated with unsecured personal loans. The share of personal loans could decline in fiscal 2025, with MSME and home loans expected to increase their share, supported by government initiatives.

What are the Advantages of Co-lending Model for the Lenders and Borrowers?

Advantages for NBFCs

- Increased Reach of Co-lending model: NBFCs can leverage their expertise in niche sectors and enhance their credit flow to the people in these segments that support financial inclusion initiatives.

- Offer Lower Interest Rates: Partnering with banks grants NBFCs access to lower-cost funds and a wider customer base. This enables NBFCs to offer competitive interest rates and customized loan products

- Credibility: For mid-sized and small NBFCs, co-lending provides access to bank funding and enables diversification, allowing them to grow in a capital-efficient manner. Also, NBFCs looking to enter the lending business can have co-lending partnerships with big banks to build credibility among the customers

- Risk Management: With the banks employing 80% of the loan capital, NBFCs can reduce the losses on their loans in case of any discrepancies.

Advantages for Banks

- Greater reach: With NBFCs’ ability to tap into the underserved sector, Banks can take advantage of this to widen their customer base and provide funds to the economically weaker strata.

- Better Customer Experience: Banks can tie up with established NBFCs to reach large audiences bridging the credit gap and instilling brand awareness.

- Risk Management: Co-lending model allows banks the flexibility to partner with one or more lenders. Hence, the risk is divided between the entities in the agreement. This adds a sense of security and minimizes the effects of loss.

Advantages for Borrowers

- Easier Access to Funds: Credit-deprived communities and people with less credit history can access formal loans easily with the co-lending model through a convenient faster disbursal process.

- Lower Rates: Customers get access to a wide range of loan products and as multiple lenders are involved in the loan process, they get loans at lower interest rates.

- Financial Literacy: NBFCs go a step ahead by not only sourcing the loans but also educating them about the loans and conditions of the lending contract in a clear and comprehensible manner. NBFCs employ dedicated customer service teams to guide customers through the lending process.

Present Challenges in Co-Lending:

- Banks at risk: As per the Co-Lending agreement, NBFCs only retain a 20% share in the individual loans. So the remaining 80% is borne by the banks that pose a higher risk if the borrower makes a default.

- Entry of corporates: The RBI has not yet officially allowed the entry of big corporates into the banking spaces, but the NBFCs are mostly filled with corporate houses. This may be risky as, in the past, DHFL, SREI, and Reliance Capita have collapsed regardless of strict monitoring by the RBI.

- High Risks: Defaults are typically higher for personal loans when compared to home loans or secured business loans. This creates higher risks for the lending partners that focus on personal loans. While government-sponsored schemes like the Credit Guarantee Fund Trust for Micro and Small Enterprises help lenders cover a portion of credit losses for unsecured business loans, the risks are far higher for personal loans without any collateral.

Growth in co-lending is supported by the controlled asset quality observed so far in the co-lending portfolios of banks and NBFCs. For the co-lending model to be successful in the long run, it is crucial to sustain asset quality and monitor regulatory developments related to the co-lending model.

Recent Growth and Trends

As more financial institutions realize the numerous benefits of the Co-lending model, it is expected to reach an upward trajectory in the future. The growth momentum for co-lending is projected to be healthy at 35-40% annually over the medium term, amid rising interest from both NBFCs and banks.

Going forward, the integration of co-lending with blockchain technology can provide a secure and transparent platform, making the process even more efficient, transparent, and cost-effective. The use of blockchain can reduce the risk of fraud, which increases the overall trust among lenders and borrowers.

What’s in for the future?

With the Reserve Bank of India (RBI) tightening its vigil on the co-lending segment, lenders are expected to become more selective about the type of credit they operate in. Top public and private sector banks such as the YES Bank, State Bank of India, and Punjab National Bank have collaborated with NBFCs over the years since the co-lending model came into existence.

With India marching towards digitization at an unprecedented pace, its liquidity issues are poised to resolve faster than usual. As the co-lending model continues to mature as the RBI intends, it will definitely be a catalyst in the financial industry to uplift the priority sector from its current economic hardships.

Role of Digital Solutions in Co-Lending

The overall efficacy of the Co-lending model depends on successful KPIs like the accuracy in risk assessment, lower cost of lending, high operational flexibility, seamless regulatory compliance, and a convenient repayment schedule. All this can be achieved only through digitization which allows for faster disbursals and ease of reconciliation. A robust digital stack with digital lending software features like CreditBureau, CYKC, Alternate data and Financial Analysis that helps in validating the document, fast decision making and quick disbursal.

CloudBankin’s end-to-end co-lending software offers technology-driven solutions for financial institutions. It’s an all-under-one-roof fully automated solution that helps manage the entire loan lifecycle, with a loan origination system and loan management system. Unlock seamless collaboration and smarter lending with Cloudbankin’s Co-lending software—Redefine your lending process today! Book a demo!

Related Post

Simplifying Credit Reporting: Data Submission to Credit Bureau Made Easy

In this blog, we will unravel the mystery of data

Review of the Best Online Digital Lending Apps and How to Successfully Build One

Do you recall the days when you would have to

How To Identify Fraudulent Digital Lending Apps? Types of Lending Frauds and Their Impact

It’s no doubt that Digital Lending Apps have taken the

- Email: salesteam@cloudbankin.com

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576