CKYC Pricing

One of the standout features of CKYC, especially when compared to similar systems in other countries, is its cost-effectiveness. For instance:

- Search: This feature is available at no cost.

- Upload, Download, and Update: The cost for these operations is approx. one rupee each respectively. This nominal fee for CKYC functionalities makes them an attractive option for financial institutions looking to streamline their KYC processes without incurring high costs.

Services | Price in INR |

CKYC – Search | 0 |

CKYC – Upload | 0.80 |

CKYC – Download | 1.10 |

CKYC – Update | 1.15 |

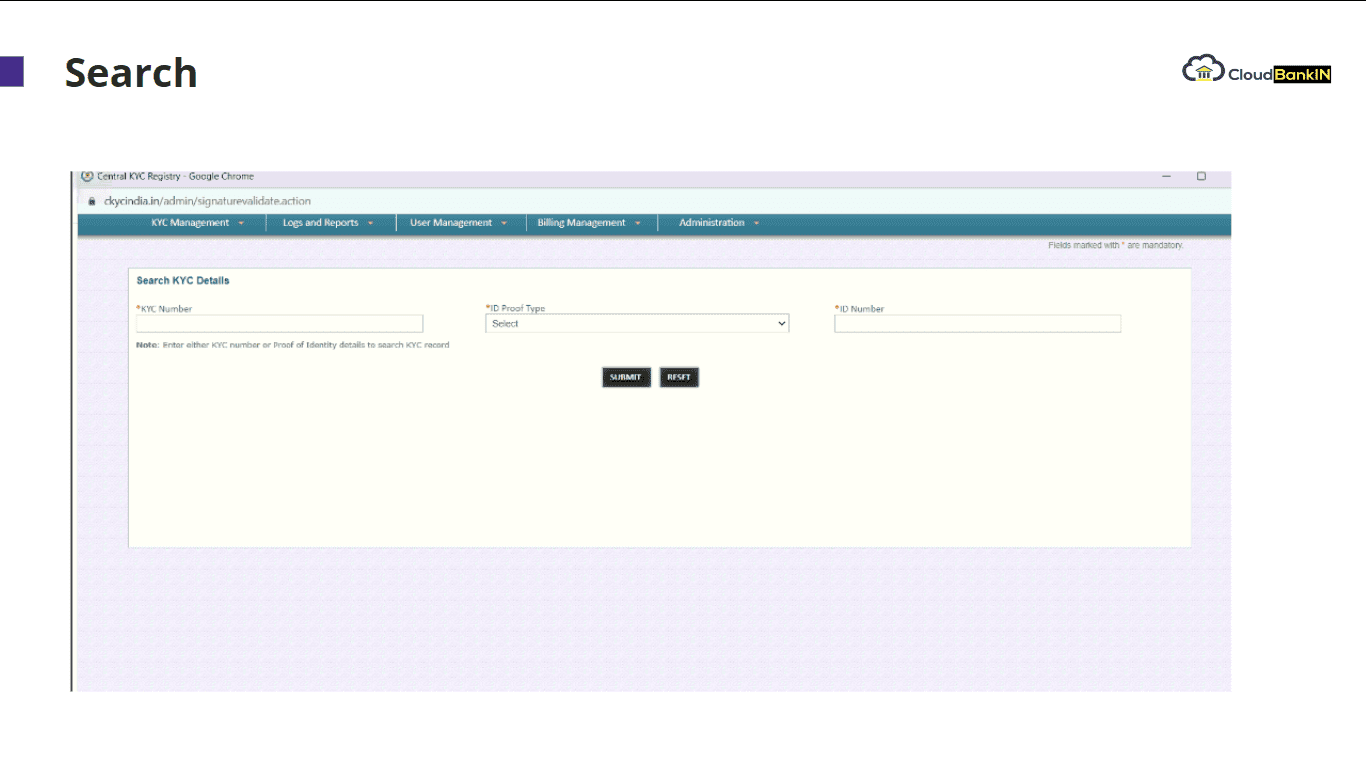

CKYC API – Search

Here’s how the CKYC API for search works:

- Integration with Loan Origination Process: When a borrower applies for a loan, they can be onboarded through various methods, such as self-onboarding, loan officers, or DSAs. As part of the loan origination process, the borrower provides basic details, including their PAN and date of birth.

- Instant Data Retrieval: Upon entering the PAN and date of birth and obtaining the borrower’s consent, the financial institution can instantly pull the borrower’s CKYC data. This is facilitated by the CKYC search API, which retrieves the CKYC ID (a 14-digit number), address, date of birth, and other relevant details.

- Automation through API: The CKYC search API can be integrated into the financial institution’s system, allowing for real-time data retrieval. For instance, if a borrower’s Aadhar OTP verification fails, the CKYC details can serve as an alternative verification method.

- Using Postman for API Testing: For technology teams, the CKYC API can be tested using tools like Postman. By inputting the PAN number and sending a request, the API communicates with the CKYC portal, retrieves the relevant data, and displays it in Postman. The primary output of the search API is the 14-digit CKYC number, name, and age of the borrower.

- Efficiency and Speed: The automation provided by the CKYC API ensures that financial institutions can quickly verify and onboard borrowers, enhancing the efficiency of the loan origination process.

View the complete workflow here.

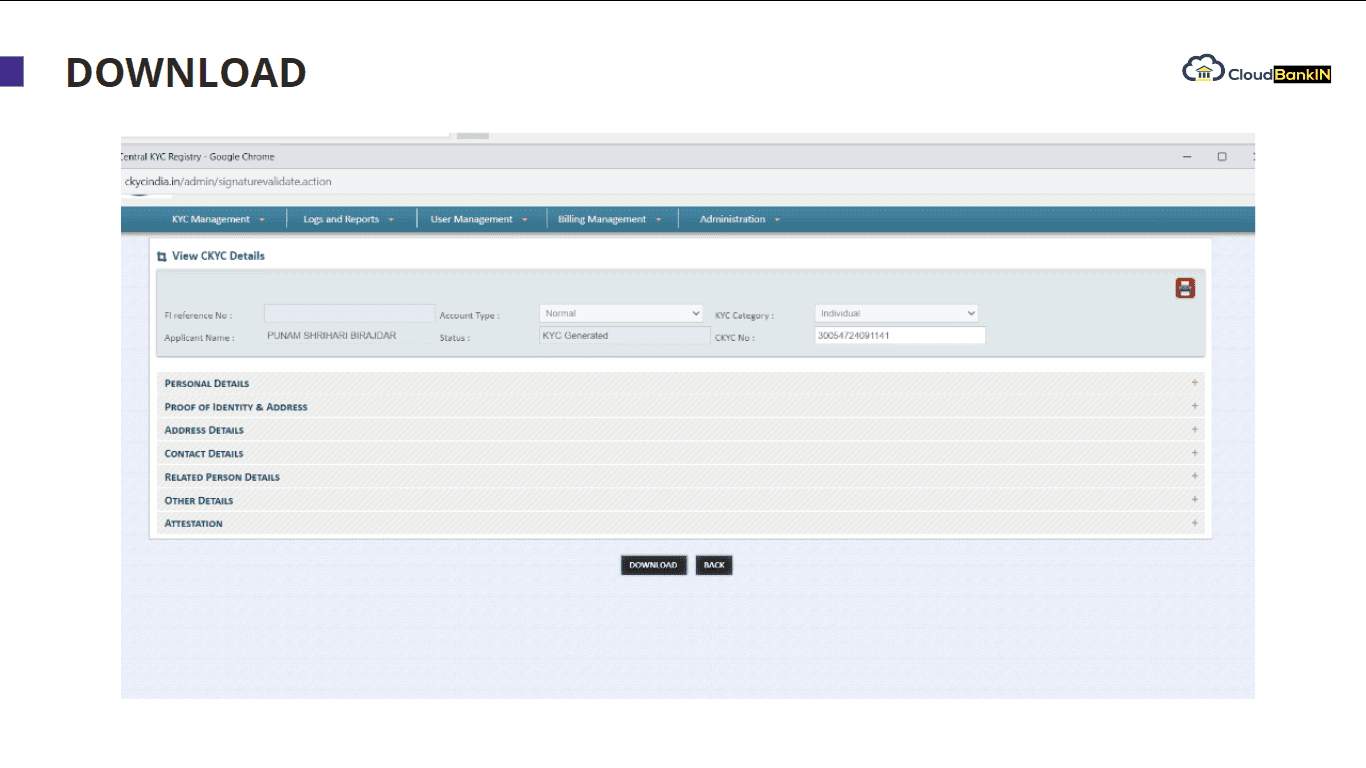

CKYC API – Download

Here’s a breakdown of how the CKYC API for download operates:

- Data Retrieval: After obtaining the CKYC number through the search API, the download API can be invoked. By providing the CKYC number as input, financial institutions can instantly pull detailed information about the customer. This includes approximately 50 to 60 parameters, offering a comprehensive view of the customer’s data.

- Integration with Loan Origination Systems: The CKYC download API can be seamlessly integrated into loan origination systems. This ensures that when a borrower applies for a loan, their CKYC details can be instantly retrieved, streamlining the loan approval process.

- Automation through API: The CKYC download API can be tested and integrated using tools like Postman. By providing the CKYC number, the API fetches the detailed data, which includes a text file with all the customer’s details in a specific format (separated by pipe symbols). Additionally, the ZIP file generated contains identification documents provided by the customer, such as passport, Aadhar, and profile details.

- Efficiency: The automation provided by the CKYC download API ensures that financial institutions can quickly access detailed customer data without manual interventions. This not only speeds up the loan origination process but also ensures data accuracy.

View the complete workflow here.

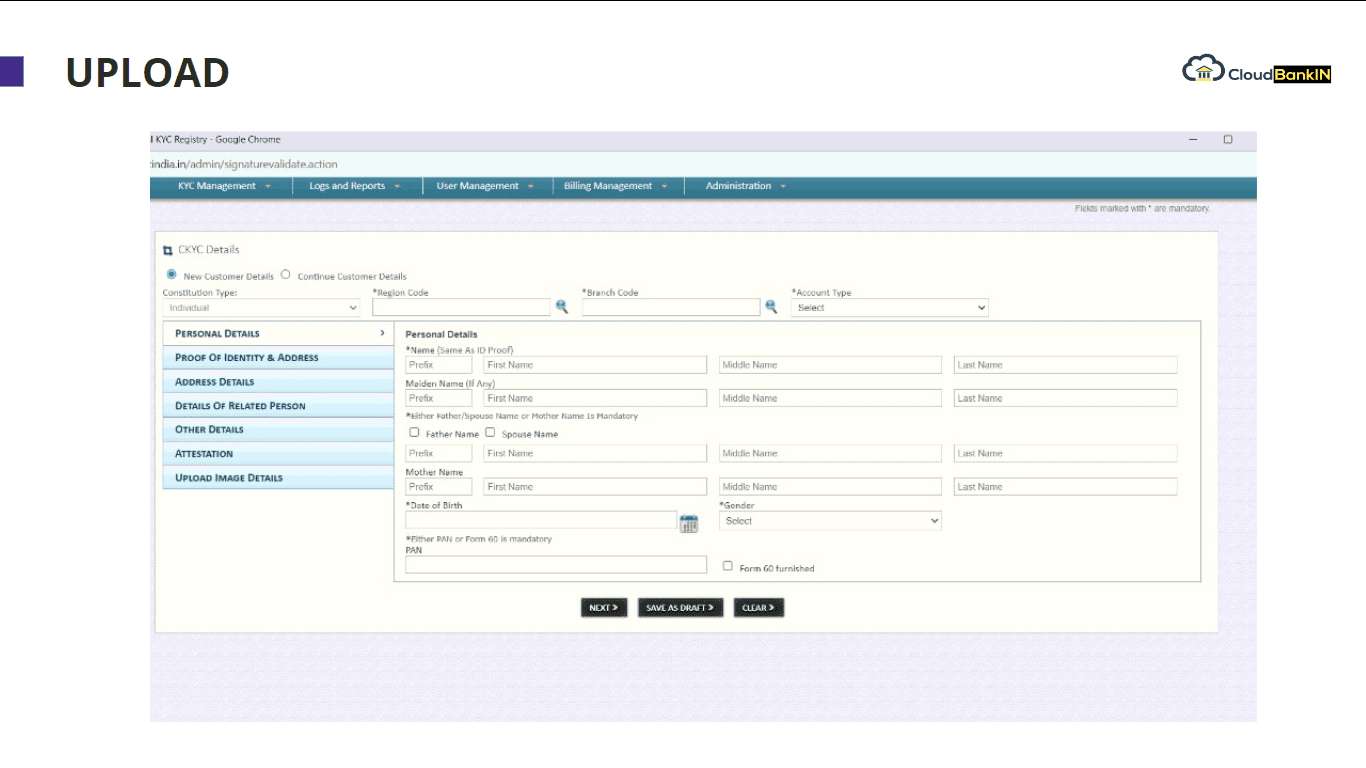

CKYC API – Upload

Here’s a detailed overview of how the CKYC API for upload operates:

- Integration with Loan Origination Systems: The CKYC upload API can be integrated into loan origination systems, allowing institutions to automatically submit customer details to the CKYC registry.

- Automated File Generation: The API generates a ZIP file containing all the necessary customer details in the required format. This ZIP file includes a text file with customer details separated by pipe symbols and any identification documents provided by the customer, such as a passport and Aadhar.

- SFTP Workflow: Once the ZIP file is generated, it can be automatically uploaded to the CKYC registry either manually or via Secure File Transfer Protocol (SFTP). The CKYC system will then process the file, and a response file will be generated, indicating the completion of the upload process.

- Efficiency and Automation: The CKYC upload API eliminates the need for manual file creation and submission, ensuring that customer data is accurately and efficiently uploaded to the CKYC registry.

View the complete workflow here.

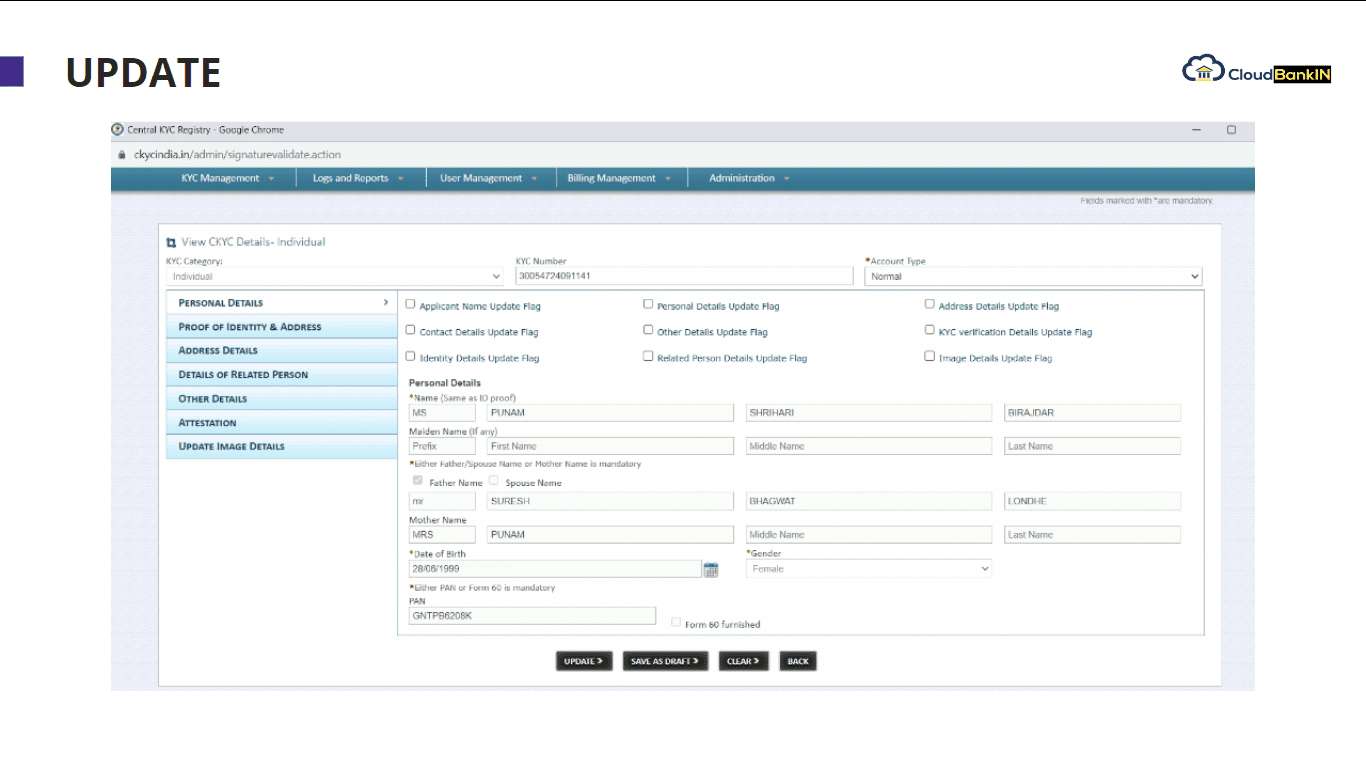

CKYC API – Update

Here’s how it operates:

- Identification of Existing Records: Before making any updates, it’s essential to identify the existing record. This is typically done using the CKYC number obtained from the search API.

- Data Modification: Once the record is identified, the CKYC update API allows institutions to modify specific details of the customer. This could include changes in address, contact details, or any other relevant information.

- Validation Process: To ensure data integrity, any updates made to a customer’s record go through a validation process. This involves a maker-checker mechanism where one user (the maker) initiates the update, and another user (the checker) reviews and approves the changes.

- Response Handling: After submitting the update request, the CKYC system processes the changes. A response is generated, indicating the status of the update. If there are any discrepancies or issues, the system will flag them, allowing institutions to rectify any errors.

View the complete workflow here.

SFTP Response Workflow

The SFTP response flow outlines the sequence of events that occur after data is uploaded via SFTP:

- Data Submission: Once the data is prepared and validated, it’s uploaded to the CKYC registry via SFTP.

- Data Processing: The CKYC system processes the uploaded data, checking for accuracy and ensuring that it meets the required standards.

- Response Generation: Once the data is processed, the system will produce responses in three stages:

a) Initially, after the SFTP upload is done, an immediate response named ‘response_0‘ will be generated in the ‘SFTP response’ folder. This is primarily to confirm the correctness of the data format.

b) During the Checker phase, this initial response is also used for authority purposes. Upon its acceptance, another response, ‘response_1’, is generated.

c) Within ‘response_1′, an 11-digit reference number is provided, which allows you to monitor the upload’s progress. The conclusive feedback, which will denote either acceptance or rejection, will be generated in 24 hours.

- Error Handling: If there are any discrepancies or errors in the uploaded data, the CKYC system will flag them. Institutions can then review the feedback, rectify any errors, and re-upload the corrected data.

- Final Verification: Once all errors are addressed and the data is re-uploaded, it undergoes a final verification process. Upon successful verification, the data is added to the CKYC registry.

View the complete workflow here.