A Comprehensive Guide to CKYC Registration for Financial Institutions

Introduction

In 2016, the Central KYC Record Registry (CKYCRR) began serving Reporting Entities (REs) regulated by major financial authorities like RBI, SEBI, IRDAI, and PFRDA. As of March 31st, 2023, CKYCRR holds over 70 crore KYC records, showing its convenience and benefits for REs and customers.

Compliance is vital in the regulated financial landscape to maintain trust among stakeholders. One crucial compliance requirement is the Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) KYC account registration for financial institutions (FIs), as it has become a crucial step for financial institutions.

Despite its significance, many are unfamiliar with the registration procedures. This blog aims to guide Banks, Urban Co-operative Banks (UCBs), Non-Banking Financial Companies (NBFCs), and other FIs through the intricacies of CERSAI KYC account registration, ensuring a seamless and compliant journey. Join me on this journey as I unravel the steps for CKYC account registration and provide a better understanding!

Step 1: Submission of Form for CKYC

Input: Submitting of Application Form in Live CKYC Environment by the FI

Output: Email containing Temporary Reference Number & Testbed Registration Link

The first step towards achieving CKYC Registration for any financial institution involves filling out & submitting an application form for CKYC at www.ckycindia.in. This form is generally filled out by the Nodal Officer/Authorised Person on behalf of the FI and demands relevant information about the institution.

The online application form is available here.

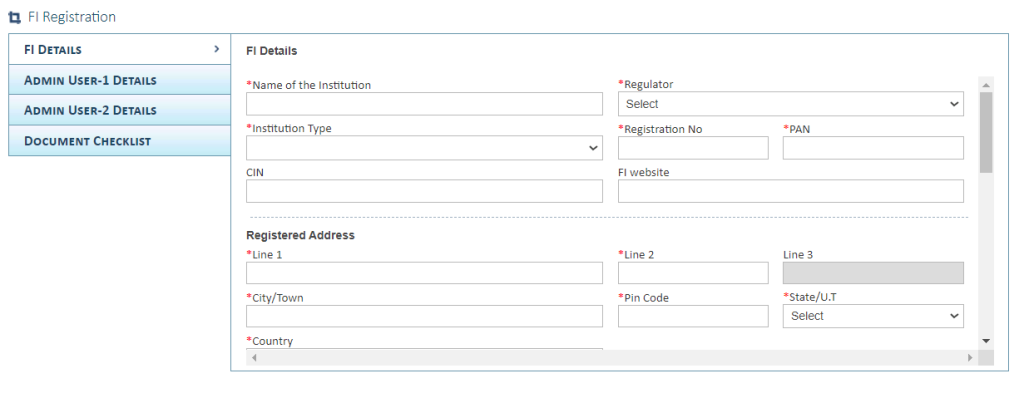

- Section 1: FI Name, Type of Regulator (such as if it’s under the RBI, SEBI, IRDA or PFRDA), FI Registration Number, PAN, Registered address, Corresponding address, FI Head Details, Nodal Officer Details.

(Image Credit: CKYC)

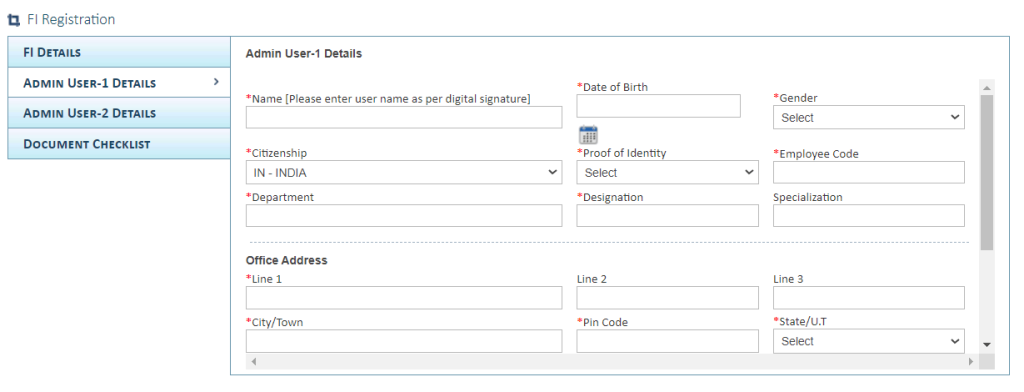

- Section 2: Admin User 1 (who will access the CKYC system) details along with office address as per Digital Signature Certificate (DSC).

(Image Credit: CKYC)

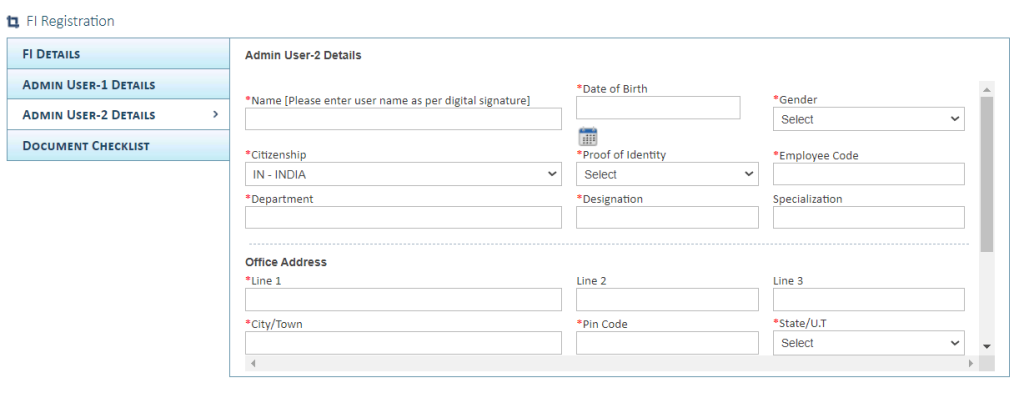

- Section 3: Admin User 2 (who will access the CKYC system) details along with office address as per Digital Signature Certificate (DSC).

(Image Credit: CKYC)

You may also like: Enhancing Customer Experience through Loan Origination System

Step 2: Request For CKYC Testbed

Input: Submission of Application Form For Testbed CKYC

Output: Email containing Testbed Login Credentials

Upon the successful completion and submission of the FI’s initial online application form, the system will produce a temporary reference number. A notification email containing this number, along with the link for test-bed registration, will then be sent to the designated nodal officer.

The next step in the CKYC registration process is to submit an online application for Testbed. This is done by accessing the official at www.testbed.ckycindia.in. The process for this step is similar to the one in Step 1.

The CKYC portal’s testbed, Central KYC Registry (CKYCR) testbed, facilitates financial institutions in acquainting themselves with the platform. It functions as a guide to help institutions’ registration process with a trial run before accessing the live environment. This platform allows them to assess the compatibility of the CKYC standards and ensure that all functionalities are working as intended. This assists institutions in understanding the complete workflow, the array of options and reports available to them via the CKYC portal. The Testbed ensures a smooth transition when the FI’s CKYC is implemented in a real-time environment.

Although the testbed is similar to the live environment in most aspects, the two are distinct entities. Separate login credentials are required for each, emphasizing their independence.

Step 3: Perform Testing

Input: Login into the Testbed CKYC Account using credentials.

Output: Submit the testing completion checklist on the testbed portal.

After the successful submission of the application form at the CKYC Testbed, the login credentials for the testbed are provided by CERSAI within 24 hours to 2-3 days. There are two login credentials provided for the maker-checker process in CKYC.

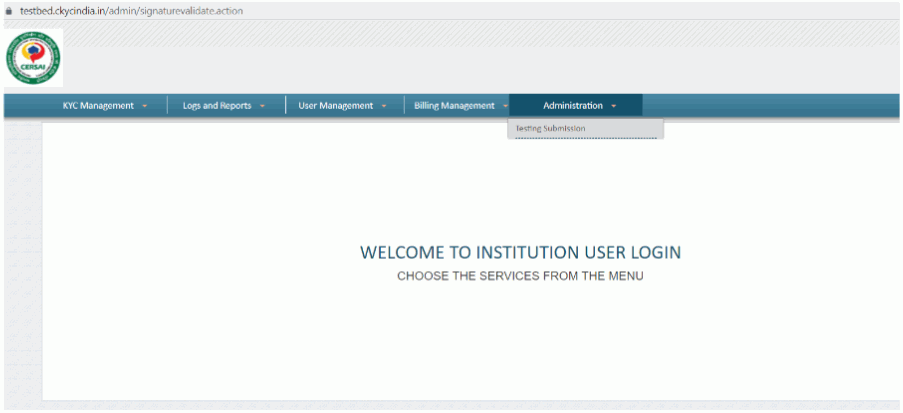

(Image Credit: Testbed CKYC)

The above screenshot will appear after entering the login test-bed credentials.

The Overall Gist of Carry-Out Testing:

Financial institutions are required to add a minimum of five test or dummy customer records. These records should include parameters such as First Name, Middle Name, Last Name, Date of Birth, Marital Status, Family Details of Father & Mother (First Name, Middle Name & Last Name), Full Address, and Identification Details (like Aadhar, PAN, etc.), Identification Proof Documents (either in PDF format or a screenshot), etc. The data can be entered manually or uploaded as a ZIP file by the financial institution. The customer record may consist of 100+ different parameters, depending on the specific requirements of each institution.

The first stage of verification, known as maker-level verification, involves basic validation checks. This step validates the input details provided by the institution. For instance, checks are made to ensure the Aadhar Number entered is a valid 12-digit number, that the attached Aadhar document doesn’t exceed 250 KB, and that in case a ZIP file is uploaded, its validity is confirmed.

The process then advances to the second stage of verification, known as checker-level verification. This stage ensures the functionality of the CKYC processes (upload, search, download, and update) is working as intended. The goal here is to confirm that the customer details provided by the financial institution are accessible on the CKYC portal. For example, if a customer’s Aadhar information is input, the system checks whether that data is available or not.

Checklist for Test-bed:

(Image Credit: Testbed CKYC)

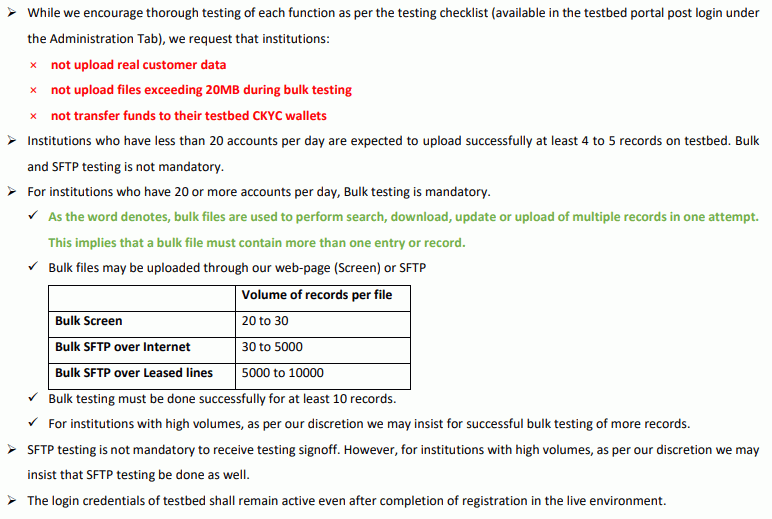

Points to be taken into consideration before carrying out testing:

(Image Credit: Testbed CKYC)

For institutions to conduct thorough testing of various functionalities, a training video is available at https://www.ckycindia.in/ckyc/trainingvideo.php. Check it out to understand each CKYC functionality testing.

Step 4: Registry Completion Testing Approval

Input: CKYC verifies the testing checklist of the FI.

Output: Email confirmation of the testing completion.

The FI will then submit the testing checklist on the testbed portal online.

CKYC Registry’s admin will then assess whether the testing has been satisfactorily completed as indicated in the checklist and will issue a sign-off for completed testing.

Upon approval of the checklist, the institution will receive a testing completion approval email from CKYC. Take a printout of that.

However, if the checklist submission is not approved,

- The institution will receive an email stating the reasons for rejection. This email will be sent to the institution’s nodal officer as specified in the CKYC testbed.

- In such a scenario, necessary actions should be taken to address the reasons for rejection before resubmitting the checklist for verification.

Step 5: Send Physical Copy of Documents to Delhi CERSAI Office

Input: Preparation of the Registration Document Set

Output: Submission of the Live CKYC Registration Request

The set of registration documents should be sent to the CERSAI Office in Delhi. This package should contain the following:

- Completed Registration Form: The form can also be downloaded as a PDF from the provided link.

- All necessary documents, as specified in the registration checklist, are given below.

- A printed copy of the email confirming the successful completion of testing.

The institution must gather the required documents. The document checklist primarily serves to verify the institution’s credibility and legality. They typically include

- Duly signed registration form of the institution.

- License/Certificate/Notification issued by the regulator.

- PAN Card of the entity.

- Corporate Identification Number (if the regulator issues multiple licenses to the entity).

- Registration Certificate (applicable to Co-operative Banks/societies).

- An authorization letter required for Admin users (must be signed by the appropriate authority, such as the authorized signatory or director).

- Certified copy of proof of identity for Admin users.

- Certified copy of the photo identity card issued by the institution for Admin users (if the institution does not provide photo IDs to employees, a signed letter from the authorized signatory stating the same, along with photographs of the admin users, will be required).

(Source: CKYC)

FI can keep track of their registration request’s progress on the live portal by clicking on the following link: https://www.ckycindia.in/admin/FIRegCheckStatusInput.jsp.

Step 6: Document Verification

Input: CERSAI verification of documents

Output: Final Approval by CERSAI

CERSAI will verify the submitted documents and grant the final approval for FI’s registration application.

Step 7: Login Credentials

Output: The registration process is complete. Login credentials are sent to the FI.

After registration is completed, the login credentials will be sent to the FI’s admins. And the nodal officer will be sent the institution code and a welcome email. The whole process usually takes from a week to a month.

You may also like: A Complete Guide to Regulatory Compliances of NBFCs

Conclusion

The registration procedure for a CERSAI KYC account is a pivotal action for financial institutions such as Banks. Co-op Banks & NBFCs. The successful registration provides these institutions with the required resources to efficiently conduct due diligence and adhere to KYC regulations. A CKYC API integration with a software solution like CloudBankin offers valuable guidance throughout this process, enabling a quicker completion of your KYC registration. Although the process is systematic, the rewards in terms of risk reduction and improved operational efficiency are substantial. The CKYC API simplifies and streamlines the integration of CKYC processes, making it a valuable tool for financial institutions in their pursuit of compliance and customer onboarding.

Glossary

Term | Full Form | Description |

CERSAI | Central Registry of Securitisation Asset Reconstruction and Security Interest of India | It is a central online security interest registry of India that was created to prevent frauds involving multiple lending from different banks on a single immovable property. |

FI | Financial Institution | This establishment is primarily engaged in financial transactions, including but not limited to investments, loans, and deposits. |

KYC | Know Your Customer | A process followed by financial institutions to verify the identity, suitability, and risks involved with maintaining a business relationship. |

CKYC | Central Know Your Customer | A centralized repository of KYC records in the financial sector with uniform norms and inter-usability across the sector. |

CKYCR | Central KYC Records Registry | An entity responsible for receiving, storing, safeguarding, and retrieving digital KYC records of customers. |

NBFC | Non-Banking Financial Company | A type of financial institution that provides certain types of banking services without meeting the legal definition of a bank. |

UCB | Urban Co-operative Bank | A financial institution formed on the basis of co-operation amongst its members. |

RBI | Reserve Bank of India | The central banking authority in India who is responsible for overseeing and regulating the monetary policy of the country’s currency. |

SEBI | Securities and Exchange Board of India | The regulator for the securities market in India, which protects the interests of investors in securities. |

PFRDA | Pension Fund Regulatory and Development Authority | A statutory authority formed by the Government of India to regulate and promote the pension sector. |

IRDA | Insurance Regulatory and Development Authority | A regulatory body overseeing and promoting the insurance and re-insurance industries in India. |

PAN | Permanent Account Number | The Indian Income Tax Department issues a laminated card in the form of a ten-digit alphanumeric number. |

DSC | Digital Signature Certificate | A secure digital key issued by a recognized Certification Authorities that certifies the identity of the holder. |

Frequently Asked Questions

What is CKYC?

CKYC, or Central Know Your Customer, is a centralized database for KYC records used by customers in financial services. Its purpose is to simplify verification, enhance security, reduce paperwork, and improve the customer experience.

Who is CERSAI?

CERSAI, licensed by the Government of India, is the central authority overseeing the CKYC or Central Know Your Customer Registry. It stores data records for each conducted KYC, ensures inter-usability of KYC records among various financial institutions, and simplifies the KYC process.

What is a CKYC software solution?

A CKYC software solution is a digital tool designed to help financial institutions (FIs) effectively fetch their customers' KYC information via API integration. This CKYC API solution facilitates integration with CERSAI and helps FIs in upload, search & download, update processes of CKYC records. It streamlines the KYC process, making customer onboarding quicker and more efficient.

What is the difference between KYC, eKYC and CKYC?

1. KYC (Know Your Customer) is a global banking policy used by financial institutions to verify their customers' identities. It involves collecting and validating identification documents like passports, driver's licenses, or other government-issued IDs. 2. eKYC (Electronic Know Your Customer) is a paperless method of conducting KYC. It utilizes technology to swiftly and efficiently verify a customer's identity and address, often using data associated with their Aadhaar number (in India). 3. CKYC (Central Know Your Customer) is a centralized KYC process initiated by the Government of India to reduce redundancy. Once completed with one financial institution, customers don't need to repeat the process with others. They receive a CKYC number, usable across financial institutions in India.

What is a 14-digit CKYC number?

The CKYC process assigns a unique 14-digit number to each individual, which is linked to their ID proof and stored securely in the CKYC registry. This number streamlines onboarding for both financial institutions and customers, eliminating the need for repeated submission of KYC documents. Furthermore, any updates to KYC details are automatically reflected across all relevant institutions through this CKYC number.

What are the types of CKYC accounts?

1. Normal Account: This account type requires presenting one of the six recognized identification documents, including PAN, Aadhaar Card, Voter's ID, Driving License, Passport, or NREGA Job Card. 2. Simplified or Low-Risk Account: If individuals cannot provide the six mentioned identity proofs, they can submit other officially valid documents (OVDs) approved in the RBI circular RBI/2015-16/42. 3. Small Account: Designed for individuals without official documentation, this account can be opened by providing personal information and a recent photograph. 3. OTP-Verified eKYC Account: To open this account, a photo and an Aadhaar PDF file from the UIDAI website are needed, requiring an OTP from the registered mobile number.

How does CKYC work? What is the flow?

From a financial institution's perspective, Central Know Your Customer (CKYC) serves as a centralized repository, streamlining the customer onboarding process and making it more efficient. Here's how it works: 1. The customer fills out a CKYC form with their personal details. 2. The financial institution verifies the provided information along with submitted documents, including cross-checking with other databases. 3. Once verified, the institution submits this data to the Central KYC Registry. 4. The Central KYC Registry processes the data and assigns a unique KYC Identifier (KYC-ID) to the customer. 5. The KYC-ID is communicated back to both the financial institution and the customer. 6. For future transactions or when the customer approaches a different financial entity, they only need to provide the KYC-ID. The new institution can fetch the customer's KYC data using this identifier from the central repository, avoiding the need to repeat the KYC process. 7. If the customer wants to update their details, the financial institution can send an update request to CERSAI. After updation, CERSAI will notify the customer's linked entities.

Which entities can register their customers for CKYC?

Financial institutions that are registered under regulatory bodies like the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), and Pension Fund Regulatory and Development Authority (PFRDA) have the option to register their customers under CKYC.

How many records does CKYC Record Registry hold?

As of March 2023, it holds over 70+ Cr CKYC records.

What is the document checklist of CKYC Registration for a financial institution?

1. Duly signed registration form of the institution. 2. License/Certificate/Notification issued by the regulator. 3. PAN Card of the entity. 4. Corporate Identification Number (if the regulator issues multiple licenses to the entity). 5. Registration Certificate (applicable to Co-operative Banks/societies). 6. An authorization letter required for Admin users (must be signed by the appropriate authority, such as the authorized signatory or director). 7. Certified copy of proof of identity for Admin users. 8. Certified copy of the photo identity card issued by the institution for Admin users (if the institution does not provide photo IDs to employees, a signed letter from the authorized signatory stating the same, along with photographs of the admin users, will be required).

What are the steps involved in registering for an account with CKYC?

1. Step 1 - The first step for any Financial Institution (FI) involves filling out & submitting an application form for CKYC at www.ckycindia.in. 2. Step 2 - The institution will get a temporary reference number. A notification email containing this number, along with the link for test-bed registration, will be sent. 3. Step 3 - The next step is to submit an online application form for Testbed. This is done by clicking the registration link in Step 2 or accessing the official site at www.testbed.ckycindia.in. 4. Step 4 - Afterwards, CKYCR provides the maker-checker login credentials for the testbed. 5. Step 5 - Login into the Testbed account, perform the required testing and then submit the testing checklist. 6. Step 6 - CKYCR will verify whether the testing has been satisfactorily completed as indicated in the checklist and will issue approval for completed testing. 7. Step 7 - Submit the required physical copies to the CERSAI Office in Delhi listed at www.ckycindia.in. CERSAI will verify and approve the FI's registration application. 8. Step 8 - A welcome email will be sent to the FI, which consists of the CKYC login credentials & the institution code.

What is CKYC Testbed?

The CKYC portal's testbed helps financial institutions get familiar with the platform. It works like a practice area where institutions can try out the registration process before using the real live platform. The testbed lets them check if the CKYC standards are compatible and if all the features (search, download, & upload) work correctly. It also helps them understand the whole process, explore different options, and view reports available on the CKYC portal. Even though the testbed is quite similar to the live platform, they are separate systems. To access each one, they need different login credentials to keep them independent. This way, when the financial institution finally starts using the CKYC in real-time, the transition is smooth and seamless.

How much time does it take for CKYC to provide the Test-bed login credentials?

Between 24 hours to 2-3 days.

How is the testing carried out in CKYC Testbed?

Financial institutions are required to add a minimum of 5 test or dummy customer records. The data can be entered manually or uploaded as a ZIP file by the financial institution. The customer record may consist of 100+ different parameters, depending on the specific requirements of each institution. The first stage of verification, known as maker-level verification, involves basic validation checks. This step validates the input details provided by the institution. For instance, checks are made to ensure the Aadhar Number entered is a valid 12-digit number, that the attached Aadhar document doesn’t exceed 250 KB, and that in case a ZIP file is uploaded, its validity is confirmed. The process then advances to the second stage of verification, known as checker-level verification. This stage ensures the functionality of the CKYC processes (upload, search, download, and update) is working as intended. The goal here is to confirm that the customer details provided by the financial institution are accessible on the CKYC portal. For example, if a customer’s Aadhar information is input, the system checks whether that data is available or not. Refer to the important points before carrying out the testing in this link: https://testbed.ckycindia.in/ckyc/assets/doc/Testbed_Checklist_V1_3.pdf.

What happens if the testing completion checklist is not approved by CKYC Registry?

1. The institution will receive an email stating the reasons for rejection. This email will be sent to the institution’s nodal officer as specified in the CKYC testbed. 2. In such a scenario, necessary actions should be taken to address the reasons for rejection before resubmitting the checklist for verification.

How much time does the whole CKYC registration process take?

Between a week to a month.

Related Post

Navigating the Regulatory Landscape: A Dive into Understanding NBFC Compliances

Overview Delve into the realm of financial compliance for Non-Banking

An Introduction To Credit Bureaus

What is a Credit Bureau? A company which collects information

10 Powerful Tools To Help Automate Your Lending Process

In a fast-paced, competitive world of the lending industry, financial

- Email: salesteam@cloudbankin.com

- Sales Enquiries: (+91) 9080996606

-

HR Enquiries: (+91) 9080996576

Quick Links

Resources

© 2023 LightFi India. All rights reserved.

(Formerly known as Habile Technologies)