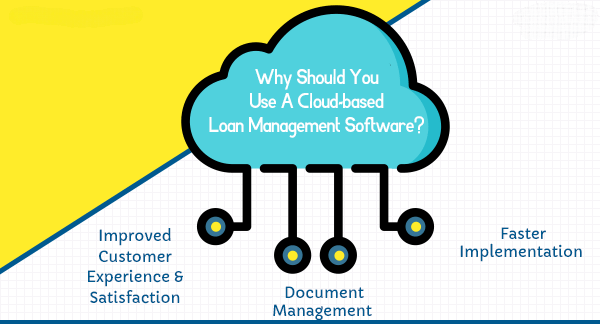

Why Should You Use A Cloud-Based

Loan Management Software

In today’s competitive market, people are lacking behind in time to complete their routine. Hence, it is important to have time-saving technology in places wherever possible – be it a loan processing system or anything that is similar.

Manual processing in financial and banking sectors often results in delayed processing. Especially, when it comes to loan management system – handling huge amount of data will slow down the entire process.

The best way to eliminate all the issues in the loan processing system is to automate it. Cloud-based loan management software speed-ups the entire process and eliminates the overheads. It helps to streamline, manage, and automate the entire loan processing system.

Read further to know more about the cloud-based loan management software…

Automated Loan-Processing System

The cloud computing technology has transformed the lending industry as well and now, lenders and borrowers are getting benefited from it. Now that the cloud-based loan processing system has come into existence and this has transformed the process to a whole new level.

Ranging from loan origination to loan servicing, cloud computing is making these services available to a broad range of clients.

This has simplified the entire process and has created the following impacts:

● Lowers the overall processing cost

● Enhanced productivity

● Increased profitability

● Eliminates the need for paperwork

● Better customer satisfaction

● Easy to process a large number of loan applications

Automation of loan processing system creates a positive impact for both the lenders as well as the borrowers. It provides a better experience for the customers by making the process simple. Also, this has streamlined the loan process and helps to meet business goals.

Cloud-based loan management platform is a boon to financial organizations and eases out the entire process. The major advantage of this platform is that it helps you to manage a large number of data sets efficiently without costing you much money.

Read further to know about the basics of the cloud-based loan processing system and its benefits…

Cloud-Based Loan Processing System

With every in business going digital, cloud platforms have become prominent and play an essential role in all the business sectors. The financial sector is no exception. In fact, cloud-based solutions are transforming the finance sector with a new perspective and solutions.

Use of cloud-based solutions has resulted in better management of the lending process and involves less paperwork. Also, the entire process from loan origination to loan servicing is completely streamlined. Cloud-based loan processing system is a way more secure than the manual system and offers extra security to the users/customers.

The customer support services are extended for 24/7 and thus, this adds an entirely new dimension to the concept. With the use of cloud-based loan processing system, banking and financial organizations can surely gain an edge over their major competitors. This also helps organizations to bring in dynamic work culture in the marketplace.

Benefits of Using Cloud-Based Loan Processing System

Cloud computing technology has the potential to transform the financial services business by completely reinventing the business model. It helps lending organizations to connect easily with their customers. At the same time, business needs are met in a shorter time within a limited budget.

This makes lending organizations focus on their business innovation, thereby building greater customer experience.

Here is the list of key facts that highlight the benefits of cloud-based loan processing system:

Improved Customer Experience & Satisfaction

A manual or traditional loan processing system is time-consuming and requires a lot of manpower. Cloud-based loan processing system helps you to overcome all these issues and reduces the overall processing time.

In a manual-processing system, lenders usually charge a higher processing fee, but when using a cloud-based system, all these overheads and other costs can be cut-off eventually. Moreover, with the cloud, you can offer more and more services to your customers across multiple channels.

The overall processing time, paperwork, error-rate, and other issues including a huge amount of manpower, workplace, etc can be reduced. Lenders need not spend long-time for completing the process and can easily get their loan amount.

In today’s competitive market, people are lacking behind in time to complete their routine. Hence, it is important to have time-saving technology in places wherever possible – be it a loan processing system or anything that is similar.

Manual processing in financial and banking sectors often results in delayed processing. Especially, when it comes to loan management system – handling huge amount of data will slow down the entire process.

The best way to eliminate all the issues in the loan processing system is to automate it. Cloud-based loan management software speed-ups the entire process and eliminates the overheads. It helps to streamline, manage, and automate the entire loan processing system.

Read further to know more about the cloud-based loan management software…

Automated Loan-Processing System

The cloud computing technology has transformed the lending industry as well and now, lenders and borrowers are getting benefited from it. Now that the cloud-based loan processing system has come into existence and this has transformed the process to a whole new level.

Ranging from loan origination to loan servicing, cloud computing is making these services available to a broad range of clients.

This has simplified the entire process and has created the following impacts:

● Lowers the overall processing cost

● Enhanced productivity

● Increased profitability

● Eliminates the need for paperwork

● Better customer satisfaction

● Easy to process a large number of loan applications

Automation of loan processing system creates a positive impact for both the lenders as well as the borrowers. It provides a better experience for the customers by making the process simple. Also, this has streamlined the loan process and helps to meet business goals.

Cloud-based loan management platform is a boon to financial organizations and eases out the entire process. The major advantage of this platform is that it helps you to manage a large number of data sets efficiently without costing you much money.

Read further to know about the basics of the cloud-based loan processing system and its benefits…

Cloud-Based Loan Processing System

With every in business going digital, cloud platforms have become prominent and play an essential role in all the business sectors. The financial sector is no exception. In fact, cloud-based solutions are transforming the finance sector with a new perspective and solutions.

Use of cloud-based solutions has resulted in better management of the lending process and involves less paperwork. Also, the entire process from loan origination to loan servicing is completely streamlined. Cloud-based loan processing system is a way more secure than the manual system and offers extra security to the users/customers.

The customer support services are extended for 24/7 and thus, this adds an entirely new dimension to the concept. With the use of cloud-based loan processing system, banking and financial organizations can surely gain an edge over their major competitors. This also helps organizations to bring in dynamic work culture in the marketplace.

Benefits of Using Cloud-Based Loan Processing System

Cloud computing technology has the potential to transform the financial services business by completely reinventing the business model. It helps lending organizations to connect easily with their customers. At the same time, business needs are met in a shorter time within a limited budget.

This makes lending organizations focus on their business innovation, thereby building greater customer experience.

Here is the list of key facts that highlight the benefits of cloud-based loan processing system:

Improved Customer Experience & Satisfaction

A manual or traditional loan processing system is time-consuming and requires a lot of manpower. Cloud-based loan processing system helps you to overcome all these issues and reduces the overall processing time.

In a manual-processing system, lenders usually charge a higher processing fee, but when using a cloud-based system, all these overheads and other costs can be cut-off eventually. Moreover, with the cloud, you can offer more and more services to your customers across multiple channels.

The overall processing time, paperwork, error-rate, and other issues including a huge amount of manpower, workplace, etc can be reduced. Lenders need not spend long-time for completing the process and can easily get their loan amount.

Frequently Asked Questions

How do LMS systems work?

a) After loan disbursement, a loan management system assists lenders in overseeing different loan-related operations. b) One of its key features is automating tasks like collecting regular payments from borrowers. c) It also does interest calculation, NPA management, charges and debt collection activities like sending notifications, reminders, and other recollection actions. d) It generates statements and reports. e) It configures terms and conditions. f) It integrates with other systems like accounting and payment gateways. g) Automating these tasks can assist lenders in saving time and minimizing errors, among other benefits. h) Additional functions may involve addressing customer service inquiries and submitting reports to credit bureaus.

What should I look for in a Loan Management Software?

When selecting a loan management software, it is important to consider several key factors, including Its ability to manage various types of loans, such as personal, business, mortgage, and student loans, etc The software should also have the capability to coordinate well with the loan origination software. It should offer loan servicing features like disbursement, repayment, interest calculation, NPA management and set-up charges. It should be able to facilitate debt collection activities such as reminders, notifications, and recovery actions. The software should also be able to generate accurate and timely reports and statements for both lenders and borrowers. It should be able to integrate with other systems and platforms like CRM, accounting, and payment gateways. It should be able to maintain secure compliance with relevant regulations and standards.

Related Post

Impact of Budget 2021 on Banks & NBFCs

As COVID-19 wreaked havoc across industries in India in 2020,

Conclusion: Significance of Uniform Credit Reporting For Financial Institutions

Significance of Each Segment in the Uniform Credit Reporting Format

5 Use Cases to drive ROI through BNPL as a Lender

The pandemic-induced economy has expanded the credit market in India

- Email: salesteam@cloudbankin.com

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576