Numerous banks offer some great financial products in India. But if you’re looking for swiftness, variety and efficiency, who do you turn to? NBFCs (Non-Banking Financial Companies) are save-the-day institutions that provide a plethora of financial products like loans, credit facility, stock investments and Term Finance Certificates (TFCs: instruments issued by companies to generate short and medium term funds), and they do it quicker and with fewer procedures than banks. Some even use NBFC Softwares in order to speed up the process.

What are NBFCs?

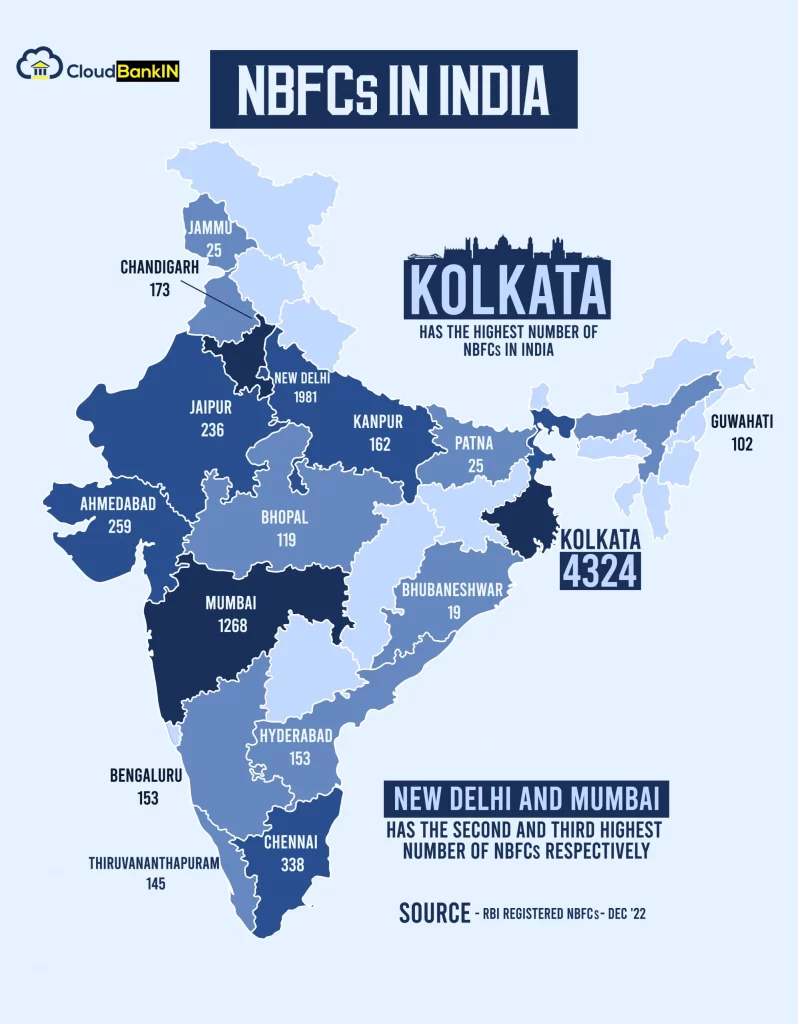

These are companies that, just like banks, offer loans, advances, stocks, bonds, debentures, securities, retirement funds, mutual funds and umpteen more products to the general public, without being classified as a bank. Regulated by the Reserve Bank of India (RBI) and Ministry of Corporate Affairs, NBFCs are not allowed to take deposits of any kind from the public. The 9600-odd NBFCs in India account for about 12.5% of its overall GDP and their outreach extends from big metropolises to urban settlements and even rural areas.

Role of NBFCs in India

These non-bank lenders push through chit-reserves, pension funds and alternative investments by servicing SMEs, start-ups and individuals. The financial year 2018-19 saw the NBFC sector swell to ₹30.9 lakh crores, a 15.2% increase from the previous year. Not only do NBFCs generate employment opportunities for people outside the banking sector, but they are critical for liquidity in a vibrant Indian financial market.

NBFCs have in recent times, adopted strong technological tools like softwares and applications to penetrate tier-3 and tier-4 towns in India and facilitate lending to up-and-coming individuals and enterprises. Their transparency, speed of service and flexibility make them better choices for borrowing than traditional banks.

Ranking Criteria for NBFCs

NBFCs have pierced through an assortment of sectors like asset financing, micro financing, mortgages, infrastructure financing and other investments. In today’s volatile Indian economy, making the right selection of NBFC to avail a product has become very difficult. However, some of them are using high potential NBFC Softwares to ease the process. Throw in the COVID-19 Coronavirus pandemic this year, and the decision process is even tougher. But here’s a silver lining – with the following criteria, hopefully the right choice will come to mind in no time.

- Annual Turnover

- Market Capitalization

- Customer Reach and Engagement

- Digital Adoption

- Response to Market Turns

You May Also Like: Top NBFC and MFI Associations in India

Bajaj Finance Limited

Founded by the legendary Rahul Bajaj and currently run by his son Sanjiv Bajaj, this company is a titan NBFC under the Bajaj Finserv Limited banner. It operates across 1,400 branches and employs over 20,000 people. Its portfolio is a goodie bag of products: business loans, gold loans, mortgages, entrepreneur loans, general insurance, health insurance, wealth management services, you name it. The company has a mammoth market cap of ₹2.08 lakh crores, net sales of ₹23,822 crores and is highly diversified.

Shriram Transport Finance Corporation Limited (STFC)

Mahindra & Mahindra Financial Services Limited (MMFSL)

Power Finance Corporation Limited (PFC)

Sundaram Finance Limited

You may also like: Is P2P Lending Really A Threat To Non-Banking Financial Companies (NBFCs)?

Manappuram Finance Limited

Muthoot Finance Limited

Muthoot Finance Ltd. is a gold loan heavyweight NBFC that was established in 1939 by MG Muthoot and leads India’s gold loan and finance market. With net sales of ₹8,714 crores and spread across 4,400 branches, the company also offers foreign exchange services, money transfer and wealth management. It’s target clientele are small businesses, farmers, traders, vendors and salaried individuals. This market outreach won Muthoot the Skoch Financial Inclusion Award in 2013,a recognition of its extension to offer financial services to rural areas.

L&T Financial Services

Magma Fincorp Limited

Publicly held non-banking financial company Magma Fincorp Limited has been in business since 1989, headquartered in Kolkata and incorporated by current chairman Mayank Poddar. The enterprise has a gamut of products under its portfolio: commercial, car and utility vehicles finance, construction equipment finance, SME loans, used asset finance, housing loans, auto leasing and insurance. Magma’s net profits jumped 3 times from ₹10.64 crores in June 2019 to ₹37.71 crores a year later, netting ₹2,177 crores in sales. It also collected the prestigious “Best NBFC of the Year” award at the 2019 India Banking Summit and Awards.

Reliance Capital Limited

Motilal Oswal Financial Services Limited (MOFSL)

With “Wealth creation through knowledge” as their core purpose, promoters Motilal Oswal and Raamdeo Agarwal in 1987 founded today’s highly diversified MOFSL. The company works through 6,000 employees in 2,500-plus locations across 550 cities in India and provides a range of products: retail and institutional broking, wealth management, investment banking, private equity, asset management and home loans. It was bestowed ‘Brand of the Year’ award at CNBC TV18 Indian Business Leadership Awards 2018. MOFSL is also technologically forward with advanced NBFC software and informative research reports. Net sales – ₹1,269 crores.

CreditAccess Grameen Limited

As of mid-2020, CreditAccess Grameen Limited stood in the top-10 list of ‘Highest Market Cap’ non-banking financial companies with ₹8,341 crores. Udaya Kumar Hebbar manages the India operations that is spread across 516 branches in 132 districts in India with ₹1,683 crores in net sales. The company focuses primarily on rural and low-income households with products like family welfare loans, home improvement loans, emergency loans, income generation loans and life insurance. Owing to its rural market outreach, CreditAccess has notched the SKOCH Awards twice – first the Financial Inclusion Award (2013) and the Resilient India Award (2017).

You may also like: How Management Information Systems (MIS) Help The NBFC Companies?

Tata Capital Limited

Another household name on this list is Tata Group with its NBFC arm Tata Capital Limited. It’s a Systematically Important Deposit Accepting Non-Banking Financial Company that was founded in 2007 and is led by Rajiv Sabharwal. Digitally driven, Tata Capital partners with Biz2Credit (online credit resource offering direct funding) to facilitate SMEs. The company offers commercial finance, consumer loans, private equity, investment banking, treasury advisory and credit cards to customers. Net income – ₹296 crores.

Edelweiss Financial Services Limited

A foremost adopter and implementer of a digital ecosystem in the NBFC space, Edelweiss Financial Services was created by Rashesh Shah in 1995. It delivers services like investment banking, private client broking, asset management, investment advisory, insurance broking, wholesale finance to corporate and HNW clients, and more. At the Finnoviti Awards in 2019 and 2020, the company won big, apart from bagging the Best Technology Implementation at CIO Conclave. Net sales – ₹236 crores.

Fullerton India Credit Co. Limited

Backed by the Singaporean company Temasek Holdings Pte. Ltd., Fullerton has made waves in the NBFC scene in India. It’s fronted by Rajashree Nambiar and offers unsecured personal, business and group loans in the retail and rural channels. Having gathered a good customer base of 28 lakh people across its 628 branches and total income of ₹5,829 crores, it launched its digital business in 2018 by partnering with aggregators like Paytm. Customers affected by COVID-19 can avail a moratorium on their repayments.

Related Post

A Comprehensive Guide to Personal Loan

IntroductionPersonal loans are un-secured lending not backed by any collateral.

Opportunities for Fintech Startups in Singapore

The “American Dream” was one of those overused buzzwords until

From Visionaries to Leaders: Meet the 19 Influential Women of Fintech Lending India

(List Updated March 2023) The winds of change have swept

- Email: salesteam@cloudbankin.com

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576